Dollar-Cost Averaging (DCA) is a simple and straightforward investment strategy that only requires investors to decide on three things: the investment selections, the amount to invest, and the investment schedule.

Investors adhering to the DCA would regularly invest a fixed amount of money regardless of the market performance.

Advantages of Dollar-Cost Average

No Need to Time the Market

With DCA, Investors are only required to follow their investment schedule and invest a predetermined amount, regardless of whether the market is up or down. There is no need to constantly ponder whether it’s the appropriate time to make their trades (Jin, Li, & Yu, 2023).

Diversifying Across Time

Some studies suggest that investors should split their investment equally over time instead of investing a lump sum into the stock market. An investor who had their life’s savings invested into the stock market in the early 2000s would see a portfolio of negative returns for an entire decade. Similar observations can be made for a lump sum portfolio in the 1970s and at the peak of 1929 (Malkiel & Ellis, 2021).

Hedging Against Volatility

One reason to diversify across time is to hedge against volatility. Dollar-Cost Averaging could decrease variance without giving up performance.

A portfolio that was slowly constructed with regular contributions over time may be less volatile than a portfolio constructed using lump sum investing. A longer averaging period could decrease volatility (Rozeff, 1994; Malkiel & Ellis, 2021; Lu, Hoang, & Wong, 2021; Dubil, 2005).

Decreases Average Price per Share

Another reason to diversify across time is to avoid buying too many shares when the market is at a premium and nothing at a discount.

Because investors would contribute a predetermined amount of money to their portfolio regardless of whether the market is up or down, this would lead to an increase in shares purchased when prices are low and a decrease in shares acquired when prices are elevated, bringing the actual average cost per share lower than the average price (Lu, Hoang, & Wong, 2021; Brennan, Li, & Torous, 2005; Dubil, 2005; Gold, 2015; Malkiel & Ellis, 2021).

Decreases Shortfall Risk

Although DCA does not decrease the probability of a shortfall occurring, if a shortfall were to happen, investors following the DCA strategy would only lose around 70% of what a lump sum portfolio would lose (Dubil, 2005).

A study conducted a worse-case simulation found that, with an initial amount of $120,000, the value of a lump sum portfolio would decrease to $73,472, whereas the value of a DCA portfolio would be $79,810 (Abeysekera & Rosenbloom, 2000).

The same study also found that, for a lump sum portfolio, 5% of the time they observed a loss of 22.0% or more (Lump Sum VaR (5%): -22.0%) while it was 12.5% or more for the DCA strategy (DCA VaR (5%): -12.5%) (Abeysekera & Rosenbloom, 2000).

Managing Emotional and Irrational Investment Decisions

Having a fixed schedule that invests a regular amount could help with managing unfavourable behaviour; by reducing investor’s responsibility, it could reduce investor’s regret, avoiding emotional and irrational investing decisions (Lu, Hoang, & Wong, 2021; Panyagometh & Zhu, 2016).

Disadvantages of Dollar-Cost Average

Not Feasible in Certain Market Conditions

Dollar-Cost Averaging may not be a viable strategy for all market conditions.

In an upward-trending market, investors would have been better off investing a lump sum from the beginning compared to splitting their investments into equal parts (Malkiel & Ellis, 2021).

Poor Cash Management

Another criticism of the DCA strategy is its poor cash utilization.

Not only was DCA scrutinized for falling short of its ability to generate additional returns, dollar-cost averaging also requires investors to hold on to liquid cash in order to utilize it at a later date (Kapalczynski and Lien, 2021).

Lack of Consensus in Performance

There is a lack of consensus regarding the performance of DCA, some studies suggest that DCA outperforms non-DCA strategy while others found that the DCA strategy falls short in generating returns compared to investing lump sum (Lu, Hoang, & Wong, 2021).

The DCA strategy is highly dependent on the market return; the higher the average market returns, the higher the likelihood that DCA would underperform lump sum investing (Lu, Hoang, & Wong, 2021).

Other Considerations

Seasonality

Another factor to consider is the DCA schedule. It has been suggested that the effectiveness of DCA changes depending on seasonality.

Lump sum investing is a more appropriate strategy during October, November, December, and January, whereas DCA would be more effective for the remaining months. Although the study found the performance difference to be around 50 to 100 basis points per year, the results were not statistically significant (Atra & Mann, 2001).

Augmented Dollar-Cost Average (ADCA)

Understanding that timing may be a factor in the effectiveness of the Dollar-Cost Average strategy, a study proposed an Augmented Dollar-Cost Averaging (ADCA) strategy.

The ADCA strategy utilizes indicators such as market volatility and unemployment rate as measures of economic conditions. Investors can adjust their investments accordingly, adopting either aggressive or conservative trading behaviour, depending on the economic condition.

The authors suggest that, if timed correctly, the performance and risk reduction of DCA can be improved (Kapalczynski, & Lien, 2021).

Supporting the idea of timing the market to improve the performance of DCA, another study found that, for a mutual fund to fully benefit from employing the DCA strategy, structuring the averaging schedule to be within the first five days of each month would observe a better performance.

Investments that begin on the first five days of the month outperform investments that are scheduled on the remaining days by 34.8 basis points per year; the difference is especially true when comparing investments that start on the last six days of the month, at 44 basis points per year (Jin, Li, & Yu, 2023).

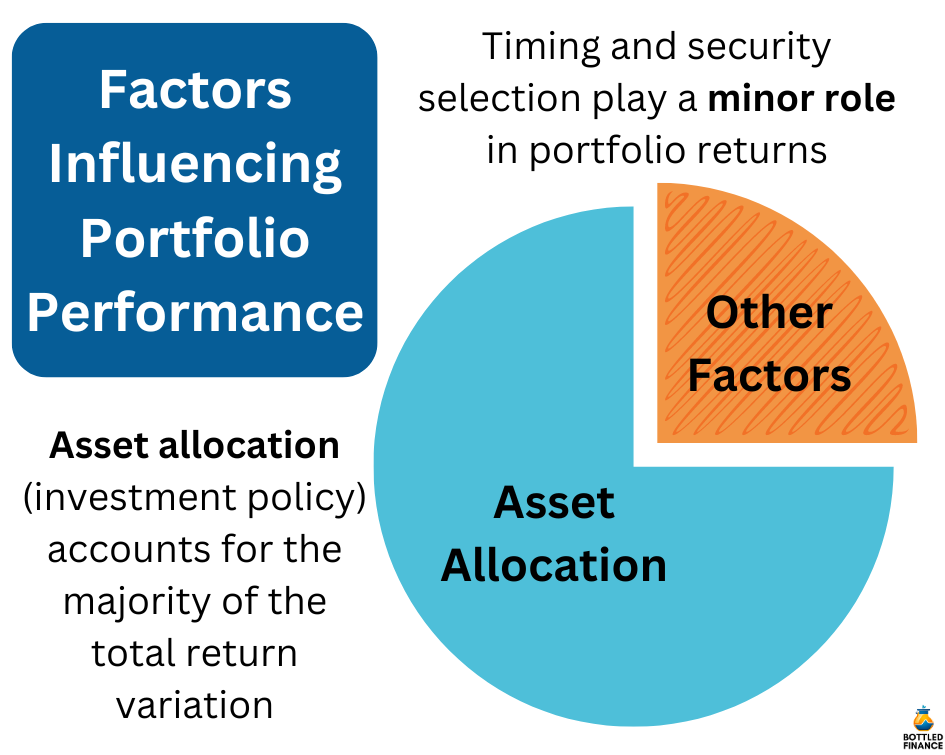

Effectiveness of Investment Strategy

However, the dollar-cost strategy alone may not yield the expected effectiveness.

A study conducted in 1986 concluded that timing and securities selection only account for a small variation of the overall portfolio return.

The main determinant of portfolio return is not due to when and how investors allocate their capital but the type of assets that are allocated to the portfolio (Brinson, Hood, & Beebower, 1995; Brinson, Hood, & Beebower, 1986; as cited in Gold, 2015).

Closing Summary

The studies referenced in this writing reflect both arguments, for and against, dollar-cost averaging; some research found reliability of DCA in decreasing the portfolio’s variation and shortfall, while others suggest that DCA may not be as effective in generating performance.

Regardless, it is the investor’s prerogative to decide whether Dollar-Cost Averaging is appropriate for their portfolio. However, heeding the words of Williams and Bacon (2004), there is “no assurance that the past patterns of stock market and T-bill returns will persist in the future”. Past performance is not indicative of future returns.

References

Abeysekera, S. P., & Rosenbloom, E. S. (2000). A simulation model for deciding between lump-sum and dollar-cost averaging. Journal of Financial Planning, 13(6), 86-96.

Atra, R. J., & Mann, T. L. (2001). Dollar-cost averaging and seasonality: Some international evidence. Journal of Financial Planning, 14(7), 98-103.

Brennan, M. J., Li, F., & Torous, W. N. (2005). Dollar Cost Averaging. Review of Finance, 9(4), 509–535. https://doi.org/10.1007/s10679-005-4999-x

Brinson, G. P., Hood, L. R., & Beebower, G. L. (1995). Determinants of Portfolio Performance. Financial Analysts Journal, 51(1), 133–138. https://doi.org/10.2469/faj.v51.n1.1869

Dubil, R. (2005). Lifetime Dollar-Cost Averaging: Forget Cost Savings, Think Risk Reduction. Journal of Financial Planning, 18(10), 86-90.

Gold, J. (2015). Money mindset : Formulating a wealth strategy in the 21st century. John Wiley & Sons, Incorporated.

Jin, X., Li, H., & Yu, B. (2023). The day‐of‐the‐month effect and the performance of the dollar cost averaging strategy: Evidence from China. Accounting and Finance (Parkville), 63(S1), 797–815. https://doi.org/10.1111/acfi.13075

Kapalczynski, A., & Lien, D. (2021). Effectiveness of Augmented Dollar-Cost Averaging. The North American Journal of Economics and Finance, 56, 101370-. https://doi.org/10.1016/j.najef.2021.101370

Lu, R., Hoang, V. T., & Wong, W.-K. (2021). Do lump-sum investing strategies really outperform dollar-cost averaging strategies? Studies in Economics and Finance (Charlotte, N.C.), 38(3), 675–691. https://doi.org/10.1108/SEF-04-2018-0107

Malkiel, B. G., & Ellis, C. D. (2021). The elements of investing : easy lessons for every investor. John Wiley & Sons, Incorporated.

Panyagometh, K., & Zhu, K. X. (2016). Dollar-Cost Averaging, Asset Allocation, and Lump Sum Investing. The Journal of Wealth Management, 18(4), 75–89. https://doi.org/10.3905/jwm.2016.18.4.075

Rozeff, M. S. (1994). Lump-Sum Investing versus Dollar-Averaging. Journal of Portfolio Management, 20(2), 45–50. https://doi.org/10.3905/jpm.1994.409474

Williams, R. E., & Bacon, P. W. (2004). Lump Sum Beats Dollar-Cost Averaging. Journal of Financial Planning, 17(6), 92-95.

Other Useful Readings

Chen, H., & Estes, J. (2010). A Monte Carlo study of the strategies for 401(k) plans: dollar-cost-averaging, value-averaging, and proportional rebalancing. Financial Services Review (Greenwich, Conn.), 19(2), 95-109.

Constantinides, G. M. (1979). A Note on the Suboptimality of Dollar-Cost Averaging as an Investment Policy. Journal of Financial and Quantitative Analysis, 14(2), 443–450. https://doi.org/10.2307/2330513

Hansen, K. A., & Carlson, S. J. (2014). USING A DOLLAR COST AVERAGING TO RANGE TRADE IN BEAR MARKETS. Journal of Business and Educational Leadership, 5(1), 71-80.

Knight, J. & Mendell, L. (1993). Nobody gains from dollar cost averaging analytical, numerical and empirical results. Financial Services Review (Greenwich, Conn.), 2(1), 51–61. https://doi.org/10.1016/1057-0810(92)90015-5