The Richest Man in Babylon is not merely a guide to personal finance, but also a captivating collection of timeless wisdom novelly described as the tales of ancient Babylonians. The unique approach of George S. Clason combines storytelling with financial principles, making it both an enjoyable read and a practical guide.

The book explores the ancient Babylonian’s way of life and perspective on wealth, revealing strategies that the wealthiest among them used to accumulate and maintain their fortunes.

The Richest Man in Babylon offers more than just financial self-help advice, it provides an alternative perspective on the meaning of wealth, the value of work ethics, and the importance of goal setting that readers can incorporate into their lives.

Through vivid narratives and memorable characters from ancient Babylon, Clason’s story imparts valuable lessons on wealth-building and financial management that remain relevant today.

This summary reflects the reader’s interpretation of George S. Clason’s “The Richest Man in Babylon”, specifically the 2002 edition. The opinions and interpretations expressed here are solely those of the summarizer.

Pay Yourself First

When Arkad was a mere scribe in the hall of records, he had the fortune of meeting a wealthy money lender, who came to request some carved tablets. It was in this meeting that Algamish imparted some of his wisdom to Arkad.

“I found the road to wealth when I decided that a part of all I earn is mine to keep”, the statement uttered by Algamish the Moneylender gives the reader a first look at the relationship of a Babylonian with their income.

The idea that you’re owed a certain amount of your income to yourself is a powerful foundation and introduction to the self-discipline of wealth management.

The Babylonians understood that the foundation of wealth accumulation lies in recognizing that, beyond covering essential expenses such as rent, food, and transportation, a portion of one’s income should be reserved for personal savings and investments.

If you pay everyone but yourself, you end up working for others rather than for your own financial future; this advice from Algamish to Arkad highlights a critical aspect of personal finance.

Your Asset Can Help Build More Assets

In the same meeting, the wealthy moneylender pointed out that: had Arkad saved just one-tenth of his earnings, he would have accumulated a full year’s worth of savings in ten years; however, had he invested those savings Arkad could have significantly increased his wealth beyond that initial amount.

In their conversation, it was evident that Algamish the moneylender views money as a resource that could help generate more resources. In his words, “Every gold piece you save is a slave that can work for you. Every copper it earns is its child that also can earn for you.”

This concept highlights that saving and investing are not just about accumulating assets but about creating a cycle of wealth-building. By effectively managing your savings, you can build assets that generate more wealth, which in turn accelerates the process of asset accumulation.

The Babylonians understood that the true value of money extends beyond immediate pleasures like good food and fine clothing. When managed properly, money can enhance income sources, increase their efficiency, and improve their quality, ultimately leading to greater financial growth.

Know What to Listen and What to Ignore

A year after their initial conversation, Algamish returned to find that, despite Arkad’s diligent savings, he had mistrusted a bricklayer’s advice on investing in rare jewels, which proved unfruitful. Recognizing Arkad’s mistake, Algamish cautioned him: “Advice is one thing that is freely given away, but make sure you take only what is worth having.”

“When managed properly” is the keyword. Identify advice that is sound and proper, and ignore those that are baseless and unwise. For instance, an investment tip from someone with limited expertise or knowledge about a company you’re unfamiliar with should be approached with caution.

Similarly, take caution of popular opinions or online investment advice from unknown sources. Such information may not be a reliable basis for financial decisions. It’s crucial to manage advice wisely, focusing on credible and informed sources while ignoring dubious recommendations.

Take Action When Opportunity Presents Itself

Now the richest man in Babylon, Arkad continued to impart his knowledge with his fellow Babylonians. During one discussion, an elderly merchant recounted his days as a younger man, where a profitable venture, that was within his grasp, was forgone due to hesitation.

“Opportunity waits for no man”, the elderly merchant recalls his father’s words. The elderly Babylonian’s story demonstrates the consequences of hesitation and procrastination when opportunity arises.

Hesitation and procrastination led the elderly Babylonian to miss an opportunity that was lost forever. Some opportunities, once missed, may never come around again.

In response, a swarthy man in the group remarked, “Good luck waits to come to that man who accepts opportunity.”

The Babylonians, in their discussion with Arkad, understood a crucial lesson: Take action when a wise opportunity arises. Whether it’s taking advantage of a promising venture, pursuing educational opportunities, or addressing a favorable investment that has turned unfavorable, decisive action is key.

Better Safe Than Sorry

Rodan the spearmaker, in his dilemma with his newfound wealth, sought the presence of Mathon, the goldlender. Of the gold pieces recently awarded to him by the king, Rodan is confounded with what to do with it. Should he offer the king’s gift to his sister’s husband, a potentially risky venture, or to keep his gold safe from loss?

This chapter of the book follows Rodan’s conversation with Mathon on the best use case for his gold. The spearmaker’s desire to help his sister’s husband comes with immense risk of loss to his wealth. As the author, George S. Clason, wrote at the end of the chapter, “Better a little caution than a great regret.”

Exercise caution to avoid unnecessary risks. It’s often wiser to be cautious and safeguard your assets rather than face the consequences of rash decisions.

Put Your Mind to It

Down on his luck and in a time of struggle, Tarkad stumbled upon an old friend whom he was indebted to. Dabasir the camel trader welcomed Tarkad to sit with him this very day, recounting the days when the wealthy camel trader was also riddled with difficulties.

Taking ownership of his situation and accepting responsibility for his circumstances, the camel trader shared the story of his resilience. With the help of Sira (the first wife of a Syrian desert chief), Dabasir managed to make his way back to Babylon, addressed his debtors, and held his head high as a free man once again.

Dabasir’s story is a powerful reminder of the accomplishments that can be achieved through determination. The camel trader, despite his initial misfortune, managed to overcome his obstacles and return to Babylon not only as a successful man but as one who had grown from his experiences.

In his words, Dabasir understood that “where determination is, the way can be found.” His journey underlines the importance of committing fully to your goals and persevering through challenges.

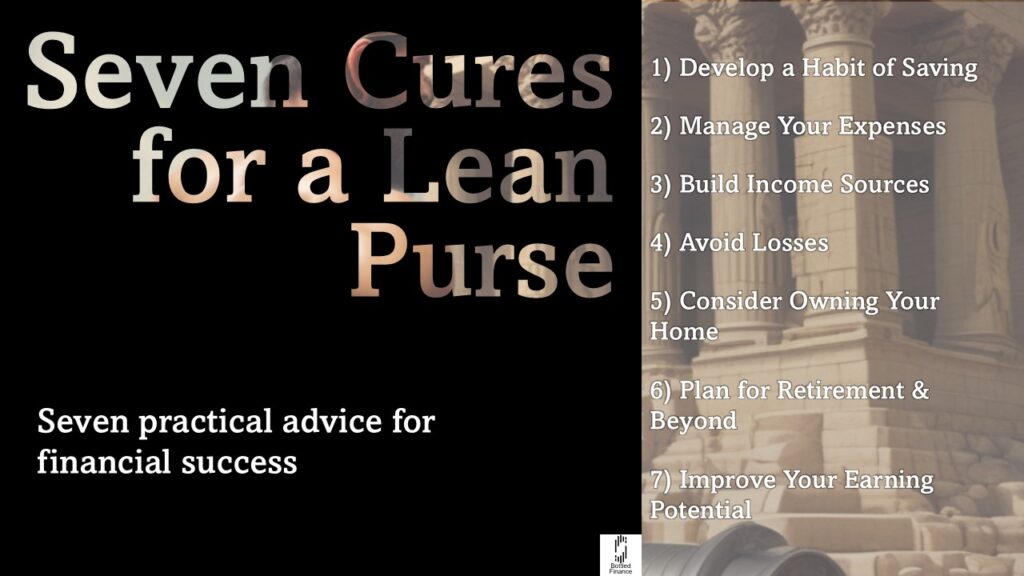

Seven Cures for a Lean Purse

The Seven Cures for a Lean Purse is, arguably, the most important chapter in the book. Presented in the earlier pages of the book, these seven cures may be common sense to some and relatively uninteresting to others, but they are powerful principles for anyone taking their wealth seriously.

The book presents seven considerations of what is required for effective personal wealth management. They serve as practical advice for financial success.

Many years after, Arkad, now crowned the richest man in Babylon, humbly obliged King Sargon’s request to teach a class of a hundred Babylonians the way of wealth. Over the course of seven days, the richest man of Babylon imparted seven vital rules, the Seven Cures for a Lean Purse.

The First Cure: Develop a Habit of Saving

Arkad began the first lesson by setting the foundation. Suggesting that the men of Babylon should set aside one-tenth of their income, for the seed of wealth is from one’s savings.

The Babylonians understood that developing a consistent saving practice was key to financial success, reinforcing the idea that the value of savings lies at the heart of wealth accumulation.

This habit of saving is essential, as it not only fosters financial discipline but also builds the crucial seed of wealth from which future prosperity can blossom.

The Second Cure: Manage Your Expenses

To achieve a saving rate of one-tenth of their income, Arkad urged his fellow Babylonians to watch their expenses. Pointing out that, while all of them have different earning capacities, their purses are equally empty; this coincident may be due to their spending habits.

The second day of teaching saw Arkad revealing that the common issue of empty purses was not solely a result of inadequate income but was often due to uncontrolled expenditures. To consistently save one-tenth of their income, it is crucial that individuals be vigilant about their spending.

While some might find saving a tenth of their income straightforward, others might face more challenges. Regardless of individual circumstances, one should recognize that improving spending efficiency could lead to better financial outcomes.

The Third Cure: Build Income Sources

Ending the discussion on the first and second cure, Arkad continued by explaining that a gold-laden purse does not do the owner any good if it’s not properly utilized. Having developed a habit of saving and proper expense management, he suggested that the next step should be to focus on putting their savings to work.

According to Arkad, true wealth is not just about the amount of money one has, but rather the income streams that one has established to continually generate more wealth. Investing and creating additional income sources are crucial steps in wealth-building.

By leveraging one’s savings to create new opportunities for income, individuals can ensure their financial growth is sustainable. This principle highlights the importance of using money as a tool for generating further wealth, reinforcing that proactive investment and income generation are key to lasting financial success.

The Fourth Cure: Avoid Losses

Arkad’s fourth lesson saw him recounting his younger days, where he had once mistrusted a year’s worth of savings to a Bricklayer, believing it would be used for a profitable jewel trade. This venture would unfortunately result in the loss of his savings.

From this experience, Arkad emphasized the importance of safeguarding one’s wealth, ensuring that the potential risks are carefully assessed and managed.

Avoiding unnecessary losses is a fundamental rule in wealth building. Protecting one’s capital from poor investments or unreliable ventures is crucial for achieving long-term financial success and stability.

The Fifth Cure: Consider Owning Your Home

On the fifth day, Arkad presented to his fellow Babylonians the benefits of owning their homes. He reasoned that, by directing part of one’s expenditure towards owning a home—rather than merely renting—they could transform a recurring expense into a valuable asset.

Arkad emphasized that if homeownership could be achieved without compromising one’s ability to save or impacting their financial stability, it would greatly enhance the growth of their wealth.

By investing in real estate, individuals not only secure a stable living situation but also potentially benefit from property value appreciation and reduced long-term living costs. The Babylonians understood the significant advantages of homeownership as a means to build wealth and financial security.

Owning one’s own property allows individuals to build equity, which can accelerate their wealth accumulation over time.

The Sixth Cure: Plan for Retirement and Beyond

The sixth cure emphasizes the importance of planning ahead, in anticipation of an event that would come. Arkad wisely suggests that one should not only focus on the here and now, but also prepare for the day when they are not able to provide for themselves and their family.

Financial goals should not only consist of acquiring luxuries or managing day-to-day expenses. The Babylonians understood the need to prepare for the future, for when an individual may not be able to work or earn.

True financial security requires planning for a time when the individual might not be able to provide for themself or their family. One should consider building assets that can support themself well into retirement as well as continue to provide for their loved ones after they’re gone.

The Seventh Cure: Improve Your Earnings Potential

In the seventh and the final lesson, Arkad stresses the importance of maximizing one’s earning potential. He highlights that an individual’s ability to earn directly relates to the value they provide. In essence, the more valuable one’s contributions are, the higher their potential earnings will be.

The richest man in Babylon understood that increasing one’s earning potential requires continuous self-improvement and skill enhancement. By consistently learning and seeking opportunities to refine one’s abilities, one can significantly boost their value.

The work ethics of the ancient Babylonians can be noted across the book. They recognized that to elevate one’s value, one must continually develop their skills and efficiency, thus improving their overall craft.

Concluding Remarks

From the tale of Dabasir, to the story of Arkad, and the dilemma of Rodan; The Richest Man in Babylon offers a captivating journey through the lives of its many characters, immersing readers with an adventure-filled narrative and insightful lessons.

Aside from what was summarized, the book also provides a vivid exploration on the topic of desires and goal setting, as well as the fundamental principles of money through the Five Laws of Gold, and many more wealth-building essentials.

This summary is only a snippet of what the book has to offer; the profound knowledge and guidance presented by the author, George S. Clason, makes this book a must-have for every individual looking to properly manage their finances.

In the summarizer’s view, The Richest Man in Babylon is one of the most influential self-help book on personal development, wealth management, work ethic, and goal setting.

References

Clason, G. S. (2002). The Richest Man in Babylon. SignetBook.