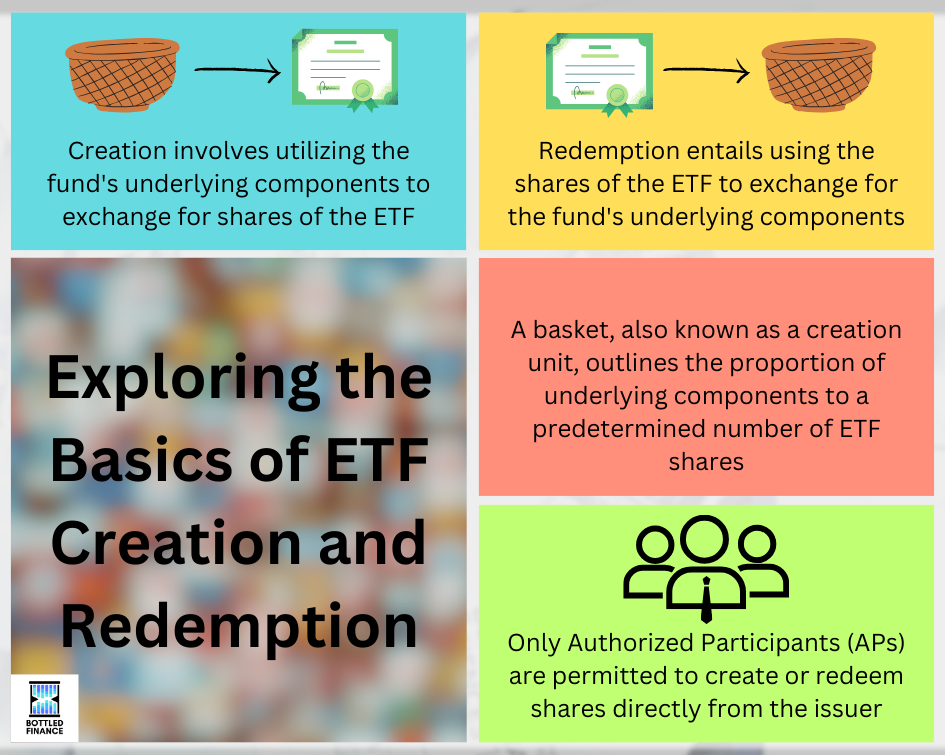

The reason why Exchange-Traded Funds usually trade at or around their Net Asset Value (NAV) is due to a feature called Creation and Redemption. Being able to create shares of ETF using their underlying component or redeem shares of ETF and receive the underlying component is a key characteristic of the fund’s design.

The process of creation and redemption is different from simply buying and selling shares of the ETF; a notable distinction is that trading occurs in the secondary market, whereas creation and redemption take place in the primary market.

Authorized Participants

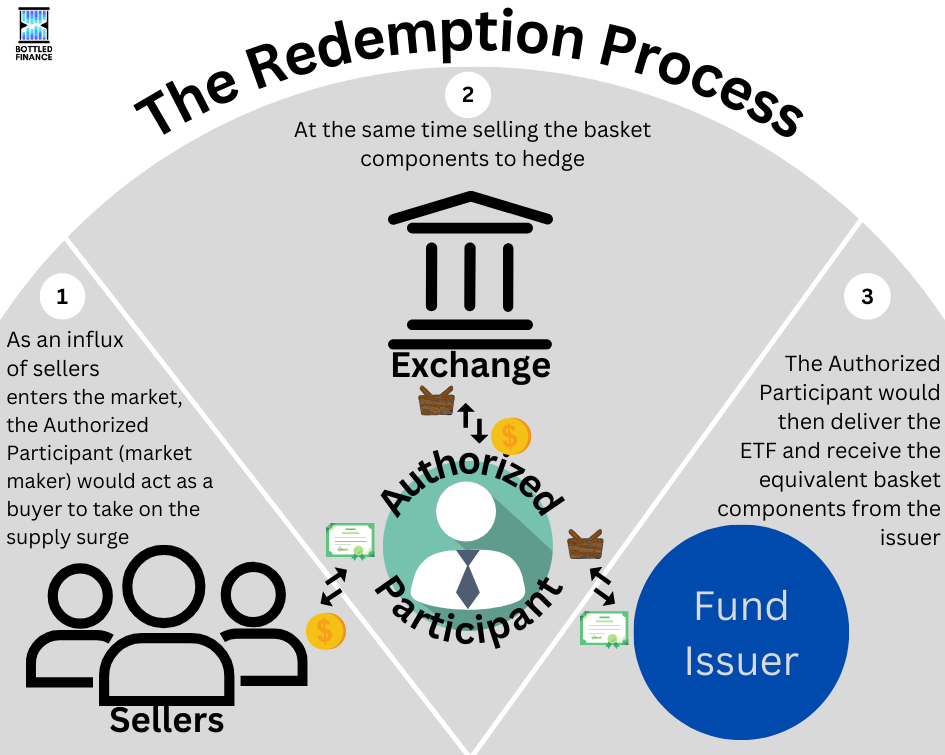

Only Authorized Participants (APs) are permitted to create or redeem ETFs from the issuer. Often made up of market makers or the trading desk from an investment banking firm, APs are entities that are in an agreement with the issuer to meet certain obligations, at which they are allowed to exchange baskets of the fund’s component in exchange for an equivalent amount of the fund’s share for creation, and the opposite for redemption.

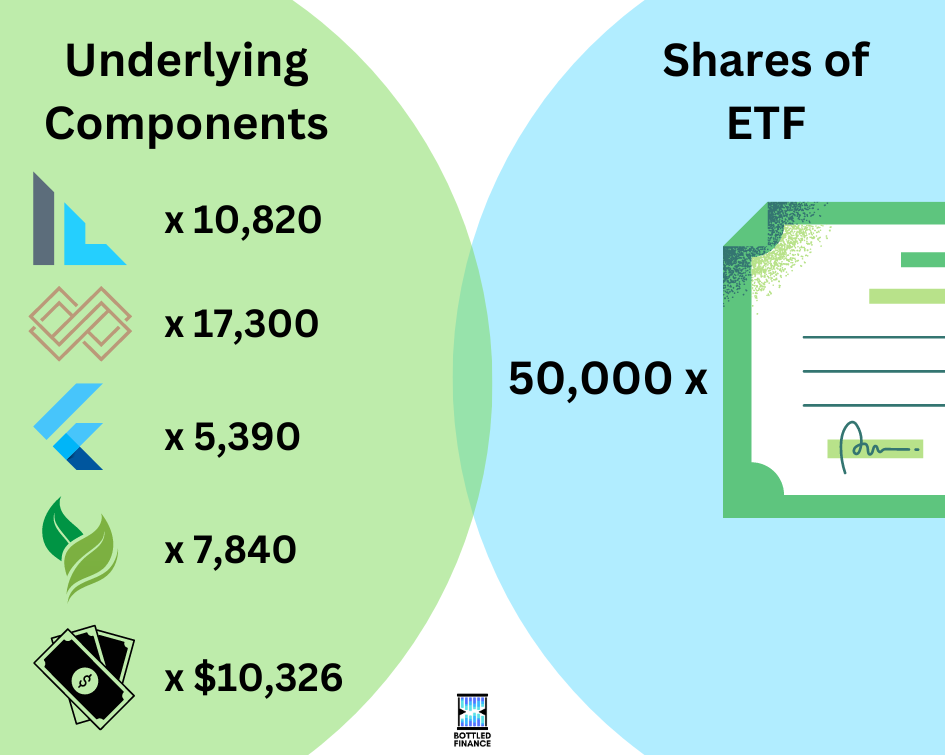

Basket/Creation Unit

The creation unit, or the basket, standardized the whole process. A basket is often in multiples of 50,000 (or more) shares of the ETF, the authorized participants could reference the basket to figure out the exact ratio of underlying components to a fixed number of shares of the ETF.

This basket, published by the issuers, not only benefits the shareholders by providing transparency but also allows the authorized participants to improve tracking, accessibility, and liquidity.

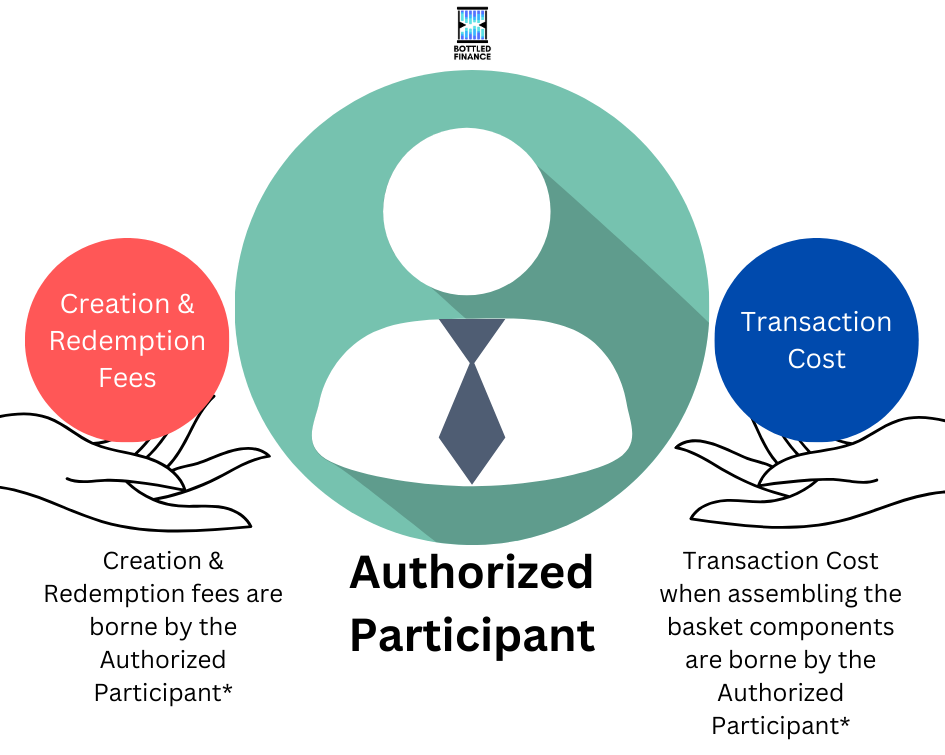

The Cost of Creating and Redeeming

Creation and Redemption Fees

Ranging from a few hundred to a few thousand dollars per request, the creation and redemption fees are borne by the requesting Authorized Participant (AP).

If the APs are market makers, they may choose to pass on this cost in the form of bid-ask spread when quoting in the secondary market; otherwise, they may impose it back to the requesting investor.

Transaction Cost

Similarly, the requesting APs are the ones that bear the transaction cost when assembling/disassembling the basket components.

If the requesting APs are market makers, they may pass on this cost in the form of a bid-ask spread on the market; otherwise, they may look to recover the transaction cost from the requesting party.

The Exchange Process

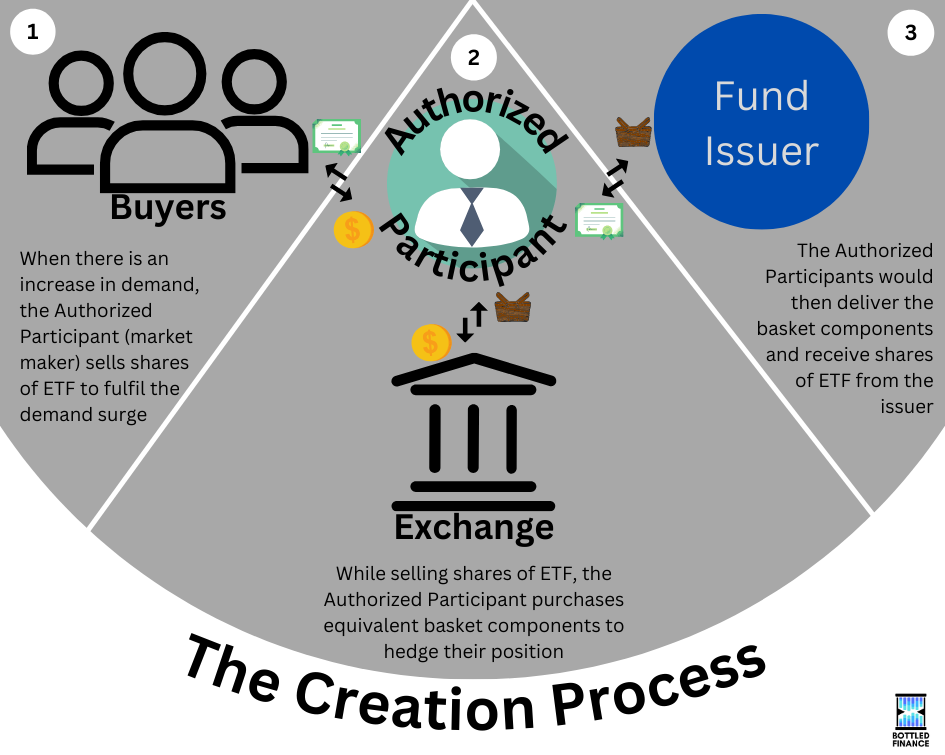

Creation

During the creation process, the authorized participant delivers the basket components to the issuer and the issuer exchanges them for shares of the ETF; as the issuer does not hold an inventory of ETFs, during the creation process the issuer essentially ‘creates’ new ETF shares that are of equivalent value to the basket received.

The creation process from start to end is a little bit more interesting:

Redemption

The process of redemption is the opposite of creation. Shares are delivered to the issuer; the issuer would then cancel any shares received and deliver the equivalent value of basket components from the fund’s portfolio, reducing the fund’s Asset Under Management (AUM) and decreasing the ETF’s outstanding shares.

In-Cash/Partial Cash-in-Lieu

ETFs that focus on outperforming a benchmark may have, in their portfolio, financial instruments that are difficult to transfer, making in-kind creation and redemption not feasible; in place of the basket components, certain fund issuers allow partial cash-in-lieu or in-cash transactions.

Tax Advantages

In-kind creations and redemptions are considered transactions in the primary market and are not regarded as trades for tax purposes, therefore, any movement of securities in and out of the fund via this process is not taxable.

Closing Summary

Allowing authorized participants to create and redeem ETFs not only serves as an inventory management solution for the market makers but it also ensures price stability because any creation and redemption is done at Net Asset Value (NAV). Furthermore, having authorized participants as market makers ensures that there will be trading liquidity.

Additionally, given that in-kind creation and redemption are not considered trades and that any transaction costs are passed on to the entering or existing investor, it provides both a tax advantage and cost-benefit for the ongoing shareholders.

References

Abner, D. J. (2016). The ETF handbook : how to value and trade exchange-traded funds (Second edition.). John Wiley & Sons.

Gastineau, G. L. (2010). The exchange-traded funds manual (2nd ed.). Wiley.

Other Useful Readings

Brown, D. C., Davies, S. W., & Ringgenberg, M. C. (2021). ETF Arbitrage, Non-Fundamental Demand, and Return Predictability. Review of Finance, 25(4), 937–972. https://doi.org/10.1093/rof/rfaa027