Given an initial principal amount, would it be better to invest the entire sum immediately (lump sum investing), or is it better to spread the investment out equally and periodically (dollar-cost average)?

Some studies suggest that spreading the investments out is advantageous to the investor’s portfolio, while others found that investing the entire amount immediately would generate a better return.

Arguments for Lump Sum Strategy

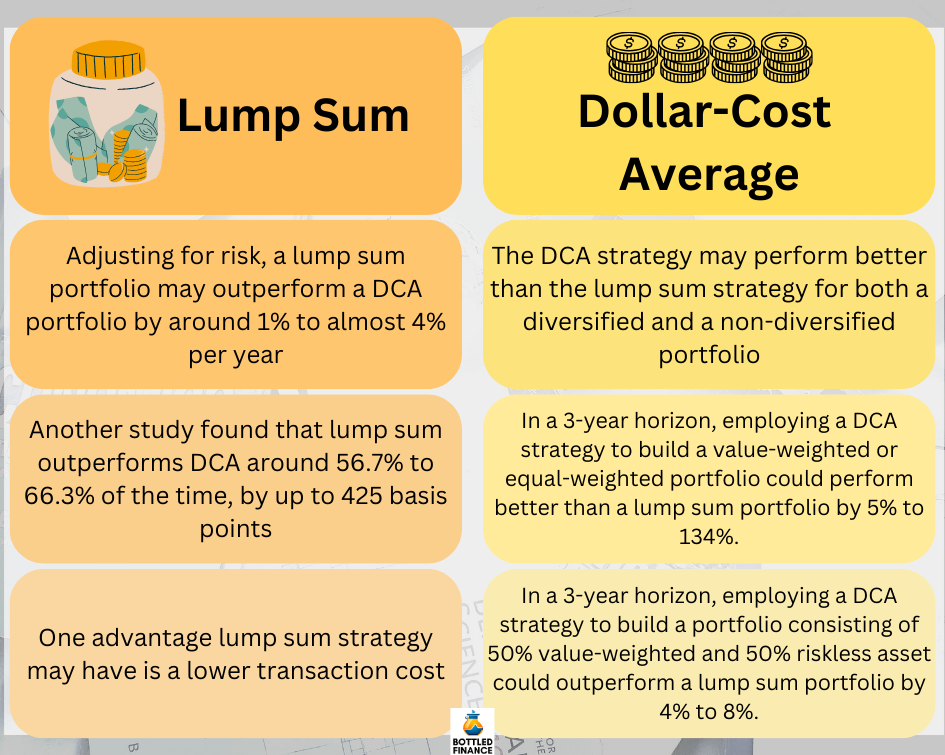

Adjusting for risk (standard deviation), over a 12-month period, lump sum portfolio was found to outperform DCA by around 1%; and for a small-stock portfolio, the effect is greater, at almost 4% per year (Rozeff, 1994).

When comparing the performance of lump sum strategy and DCA for three time periods, between 1926 to 1991, 1950 to 1991, and 1970 to 1991, A more recent study saw similar results.

Depending on both the time period and the averaging period, lump sum outperforms DCA at a minimum of 56.7% and up to 66.3% of the time. Comparing performance, the mean difference was observed to be around 0.76% to 4.25% (Williams and Bacon, 2004).

When comparing the performance of DCA, Optimal Rebalancing, and Buy-and-Hold Strategy, it was observed that, regardless of the risk management factor, DCA is not worth the additional cost and effort (Knight & Mandell, 1993).

It was also pointed out that lump sum strategy may be transaction cost advantage over Dollar-Cost Averaging (Atra & Mann, 2001).

Arguments for Dollar-Cost Average (DCA)

However, when comparing the performance of portfolio consisting of CRSP value-weighted or equal-weighted indices and a portfolio consisting of a single stock, DCA strategy outperforms lump sum strategy in both diversified and non-diversified portfolio; except in the case where the investor is extremely risk tolerant (Brennan, Li, & Torous, 2005).

Depending on the investor’s risk aversion, the weighting of the market portfolio held, and whether the portfolio is chosen with equal or value-weighted probability, in a 36-month horizon, employing the DCA strategy could outperform lump sum purchase by a marginal value of 5% to 134% (Brennan, Li, & Torous, 2005).

When comparing the marginal value of a portfolio that consists of 50% riskless asset and 50% value-weighted market portfolio, a 36-month horizon reflected that DCA strategy outperformed lump sum by 4-8% (Brennan, Li, & Torous, 2005).

In nearly all cases when the market’s mean return is 9% with a volatility of 20% or 30%, DCA outperforms lump sum investing; when the mean return is 11.5%, dollar-cost averaging also outperforms lump sum investing when the market volatility is at 30% (Lu, Hoang, & Wong, 2021).

Other Consideration

It has been suggested that the effectiveness of either strategy depends not on the strategy itself but on the direction of the market.

If the market is trending upwards then lump sum outperforms DCA, if the market is trending downwards then DCA outperforms lump sum, if the market is volatile then DCA would serve as a good strategy to avoid buying too much at the market peak and nothing at the market bottom (Dubil, 2005).

Risk/Return Trade Off

In terms of risk/return trade off, there may not be any additional benefits for employing the DCA strategy (Atra & Mann, 2001).

When considering factors such as the expected returns on stock, risk-free rates, and levels of volatility, there may not be any clear benefit of DCA over lump sum investing. Accounting for transaction cost, investing lump sum could outperform DCA in many cases (Abeysekera & Rosenbloom, 2000).

Closing Summary

This article provides a peek at the arguments on both sides.

Some studies suggest that investing the principal in its entirety may be beneficial while others found that splitting one’s capital up equally and investing them periodically may be superior.

The viability of the strategies in relation to the market condition was also discussed.

Ultimately, investors should be aware of the alternatives and weigh their strategy appropriately.

References

Abeysekera, S. P., & Rosenbloom, E. S. (2000). A simulation model for deciding between lump-sum and dollar-cost averaging. Journal of Financial Planning, 13(6), 86-96.

Atra, R. J., & Mann, T. L. (2001). Dollar-cost averaging and seasonality: Some international evidence. Journal of Financial Planning, 14(7), 98-103.

Brennan, M. J., Li, F., & Torous, W. N. (2005). Dollar Cost Averaging. Review of Finance, 9(4), 509–535. https://doi.org/10.1007/s10679-005-4999-x

Dubil, R. (2005). Lifetime Dollar-Cost Averaging: Forget Cost Savings, Think Risk Reduction. Journal of Financial Planning, 18(10), 86-90.

Knight, J. & Mendell, L. (1993). Nobody gains from dollar cost averaging analytical, numerical and empirical results. Financial Services Review (Greenwich, Conn.), 2(1), 51–61. https://doi.org/10.1016/1057-0810(92)90015-5

Lu, R., Hoang, V. T., & Wong, W.-K. (2021). Do lump-sum investing strategies really outperform dollar-cost averaging strategies? Studies in Economics and Finance (Charlotte, N.C.), 38(3), 675–691. https://doi.org/10.1108/SEF-04-2018-0107

Rozeff, M. S. (1994). Lump-Sum Investing versus Dollar-Averaging. Journal of Portfolio Management, 20(2), 45–50. https://doi.org/10.3905/jpm.1994.409474

Williams, R. E., & Bacon, P. W. (2004). Lump Sum Beats Dollar-Cost Averaging. Journal of Financial Planning, 17(6), 92-95.

Other Useful Readings

Brinson, G. P., Hood, L. R., & Beebower, G. L. (1995). Determinants of Portfolio Performance. Financial Analysts Journal, 51(1), 133–138. https://doi.org/10.2469/faj.v51.n1.1869

Chen, H., & Estes, J. (2010). A Monte Carlo study of the strategies for 401(k) plans: dollar-cost-averaging, value-averaging, and proportional rebalancing. Financial Services Review (Greenwich, Conn.), 19(2), 95-109.

Constantinides, G. M. (1979). A Note on the Suboptimality of Dollar-Cost Averaging as an Investment Policy. Journal of Financial and Quantitative Analysis, 14(2), 443–450. https://doi.org/10.2307/2330513

Gold, J. (2015). Money mindset : Formulating a wealth strategy in the 21st century. John Wiley & Sons, Incorporated.

Hansen, K. A., & Carlson, S. J. (2014). USING A DOLLAR COST AVERAGING TO RANGE TRADE IN BEAR MARKETS. Journal of Business and Educational Leadership, 5(1), 71-80.

Jin, X., Li, H., & Yu, B. (2023). The day‐of‐the‐month effect and the performance of the dollar cost averaging strategy: Evidence from China. Accounting and Finance (Parkville), 63(S1), 797–815. https://doi.org/10.1111/acfi.13075

Kapalczynski, A., & Lien, D. (2021). Effectiveness of Augmented Dollar-Cost Averaging. The North American Journal of Economics and Finance, 56, 101370-. https://doi.org/10.1016/j.najef.2021.101370

Malkiel, B. G., & Ellis, C. D. (2021). The elements of investing : easy lessons for every investor. John Wiley & Sons, Incorporated.

Panyagometh, K., & Zhu, K. X. (2016). Dollar-Cost Averaging, Asset Allocation, and Lump Sum Investing. The Journal of Wealth Management, 18(4), 75–89. https://doi.org/10.3905/jwm.2016.18.4.075