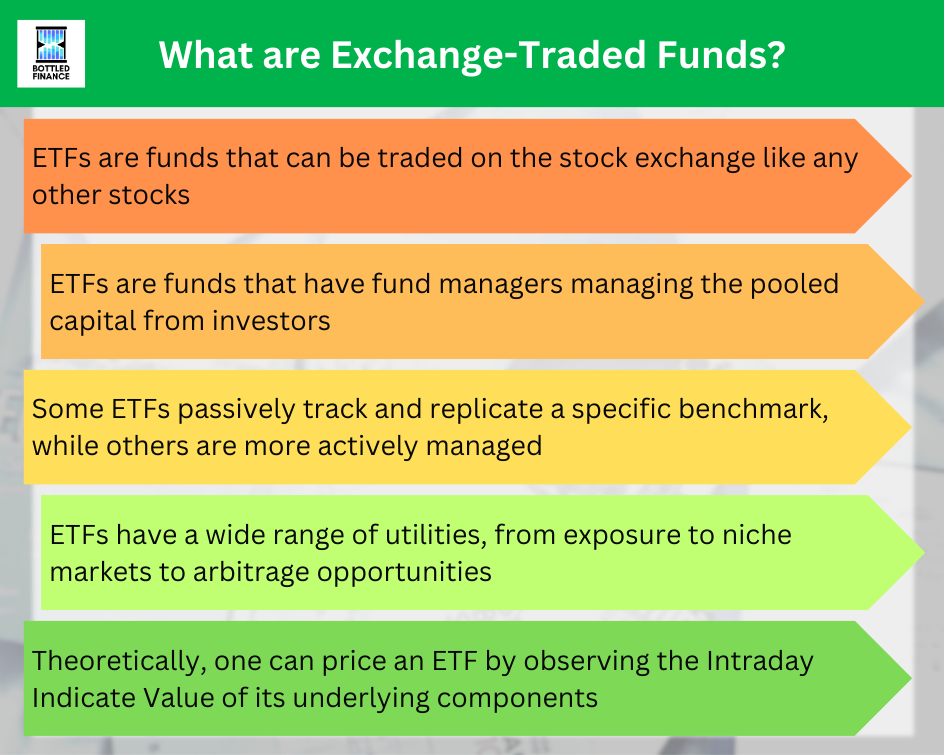

Exchange-traded funds (ETFs) are a type of financial instrument that has the characteristics of publicly traded stocks, mutual funds, and closed-end funds.

Similar to stocks, ETFs can be bought or sold on the secondary market; similar to mutual funds, ETFs can be exchanged for their underlying components and vice versa; similar to mutual funds and closed-end funds, ETFs are funds that pooled capital from different investors and a fund manager would allocate the capital according to a specific strategy type.

ETF Objectives and Strategies

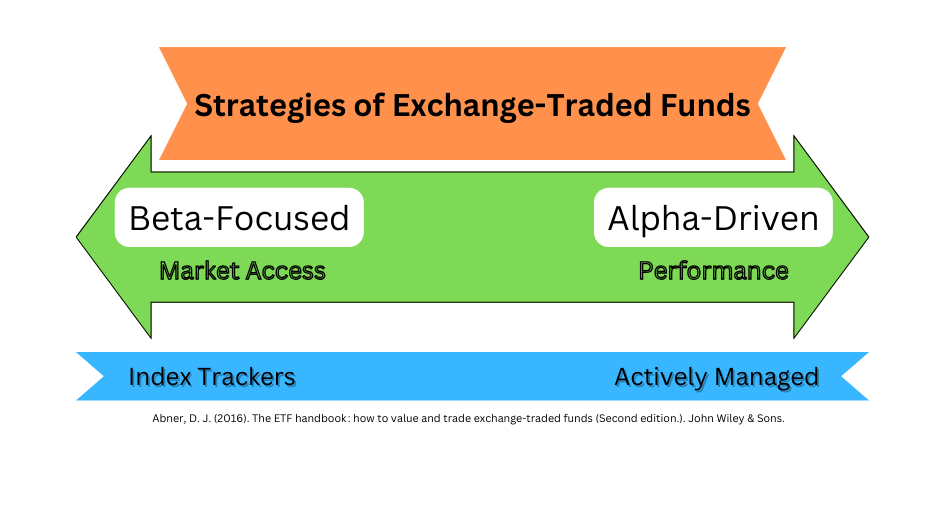

Beta-focused Strategy/Market Access

A Beta-focused fund aims to provide its investors with exposure to a particular index, region, country, commodity, currency, or market sector.

An example of a Beta-focused strategy would be an ETF that passively tracks a particular index and replicates the benchmark index’s performance by constructing its portfolio to mimic the target index’s constituents or an ETF that tracks the performance of gold would hold gold or gold equivalent.

Alpha-driven Strategy/Performance

An Alpha-driven fund aims to outperform the typical index’s returns. They may be actively managed whereby the fund managers would decide which securities to invest in or they could be passively managed funds that track and replicate new indexes.

An example of an alpha-driven strategy would be an ETF that allocates its resources into derivatives that allow returns to be amplified.

Comparing ETFs and Closed-End Funds (CEFs)

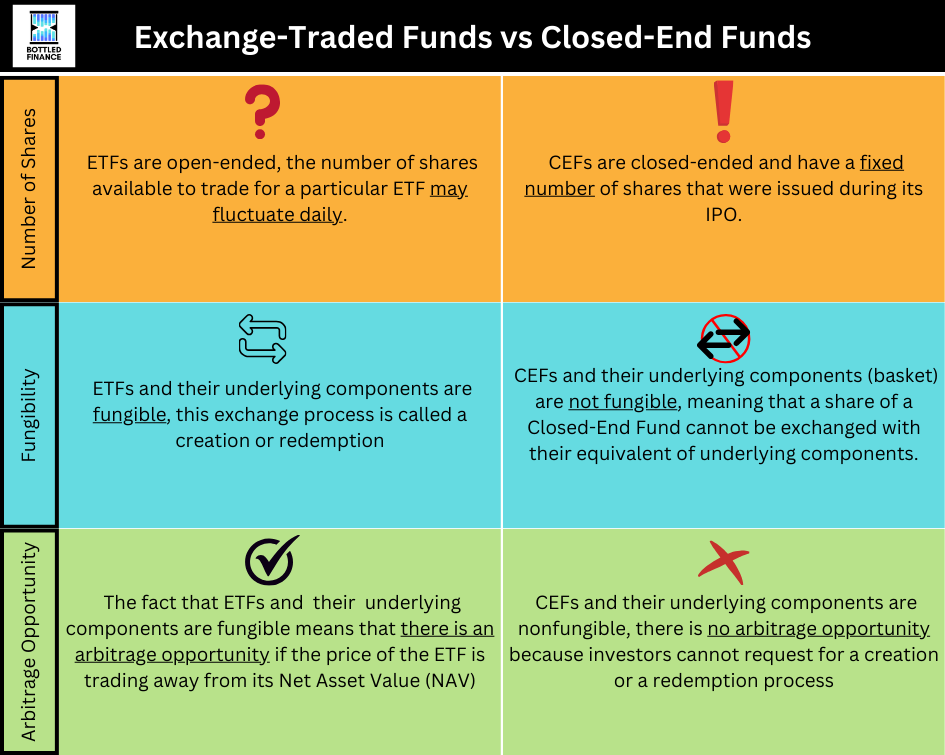

Number of Share Available

CEFs are closed-ended and have a fixed number of shares that were issued during its IPO.

ETFs are open-ended, the number of shares available to trade for a particular ETF may fluctuate daily.

Fungibility

The reason that the number of shares available to trade for ETF fluctuates is because of fungibility.

CEFs and their underlying components (basket) are not fungible, meaning that a share of a Closed-End Fund cannot be exchanged with their equivalent of underlying components.

ETFs and their underlying components are fungible, this exchange process is called a creation or redemption.

If 50,000 ETF shares are equivalent to its basket components of 10,000 shares of company A, 5,000 shares of company B, and $350, an investor could purchase those components and exchange for 50,000 shares of the ETF.

Arbitrage Opportunity

The fact that ETFs and their underlying components are fungible means that there is an arbitrage opportunity if the price of the ETF is trading away from its Net Asset Value (NAV).

If the ETF is trading at a premium compared to the underlying basket’s NAV, investors could sell the ETF and purchase the equivalent basket components to profit from the spread.

However, given that CEFs and their underlying components are nonfungible, there is no arbitrage opportunity because investors cannot request for a creation or a redemption process.

Do note that this process can only be done by an Authorized Participant (AP).

Comparing ETFs and Mutual Funds

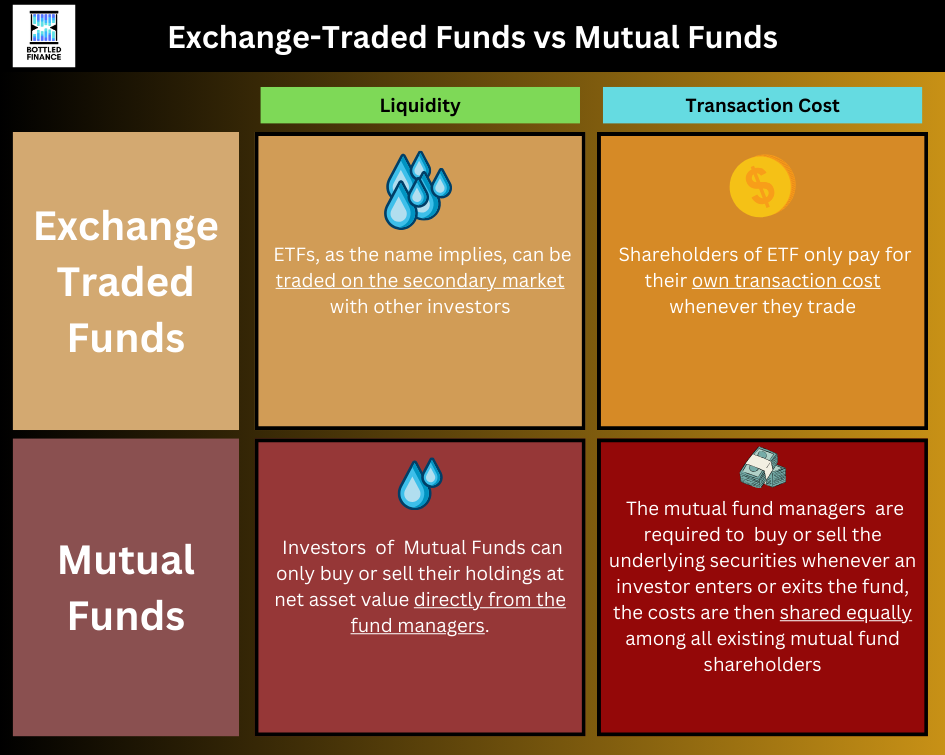

Liquidity

ETFs, as the name implies, can be traded on the secondary market; investors looking for exposure in a certain ETF can purchase them at the market price from other investors.

Investors of Mutual Funds can only buy or sell their holdings at net asset value directly from the fund managers and therefore do not have a similar degree of liquidity.

Transaction Cost

In many cases, shareholders of ETF only pay for their own transaction cost whenever they trade that ETF; that is, they only pay the transaction cost when they buy and sell the fund on the exchange because creations and redemptions are usually done in-kind, meaning that the components are used to exchange shares of the ETF (creation) or shares of the ETF is used to exchange the equivalent value of the component (redemption).

Mutual Funds, however, do not have that arrangement. The mutual fund managers are required to buy or sell the underlying securities whenever an investor enters or exits the fund, the costs are then shared equally among all existing mutual fund shareholders.

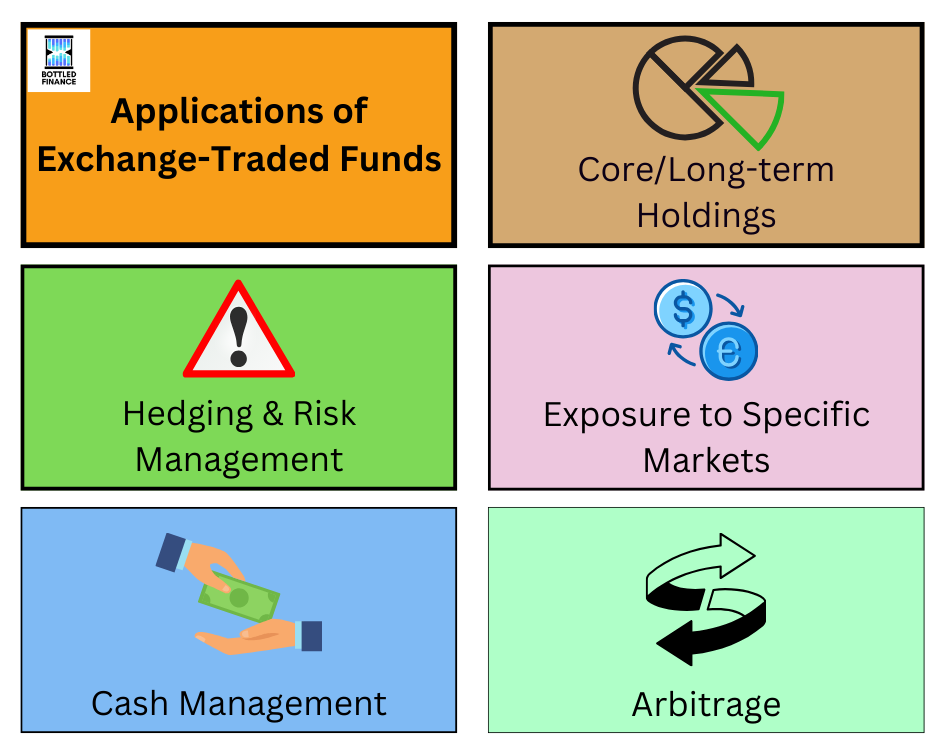

Applications of ETFs

Core/Long-term Holdings

One of the more obvious applications, ETFs can be adopted as a core asset allocation for retail and institutional investors to build a portfolio with a focus on equity, fixed income, commodities, or other niche investment areas.

Hedging/Risk Management

Given that ETF encompasses a pool of securities, financial advisors and institutional investors can use ETFs to manage their portfolio’s risk exposure as well as to reduce costs for their clients.

Exposure to Specific Market

ETFs allow investors to gain exposure to niche markets that were previously too costly or illiquid. For example, investors looking for exposure in the gold market can now trade an ETF that tracks and replicates the performance of gold instead of purchasing and storing gold bullion themself.

Cash Management

Investors looking to manage their excess cash can look into investment-grade bond ETFs as a possible cash management strategy.

Arbitrage

When the price of the ETF is trading at a value different from the Net Asset Value (NAV) of its underlying components, there is an opportunity to profit off the price difference because ETFs and their equivalent basket are fungible.

Do note that this process can only be done by an Authorized Participant (AP).

Pricing an ETF

As the issuers would publish the Net Asset Value and the underlying components of the fund, pricing an ETF is relatively straightforward.

Theoretically, ETFs should trade at or close to the NAV of its underlying components (because trading away from the NAV creates arbitrage opportunity); therefore, tracking the Intraday Indicative Value (IIV) of the underlying basket of securities is a sound pricing methodology, especially near the market close as the NAV is calculated using the closing price of the underlying securities (including the cash component).

References

Abner, D. J. (2016). The ETF handbook : how to value and trade exchange-traded funds (Second edition.). John Wiley & Sons.

Gastineau, G. L. (2010). The exchange-traded funds manual (2nd ed.). Wiley.

Madhavan, A. N. (2016). Exchange-traded funds and the new dynamics of investing. Oxford University Press. https://doi.org/10.1093/acprof:oso/9780190279394.001.0001