Fixed income instrument? Safe haven or risky venture?

Bonds? Simply put, they are fixed-income instruments! When a company, government, or other entity wants to raise money to fund their ventures, and if they choose to borrow from the public, they’ll issue bonds!

Bonds are just loans that require the borrower (the issuer) to pay the lender (the bondholder) a periodic interest rate and the lump sum back at the end of the loan term!

There are two simple ways to make a profit from bonds:

- From the regular interest payments

- From the difference between the price paid and the lump sum received at maturity (par value)

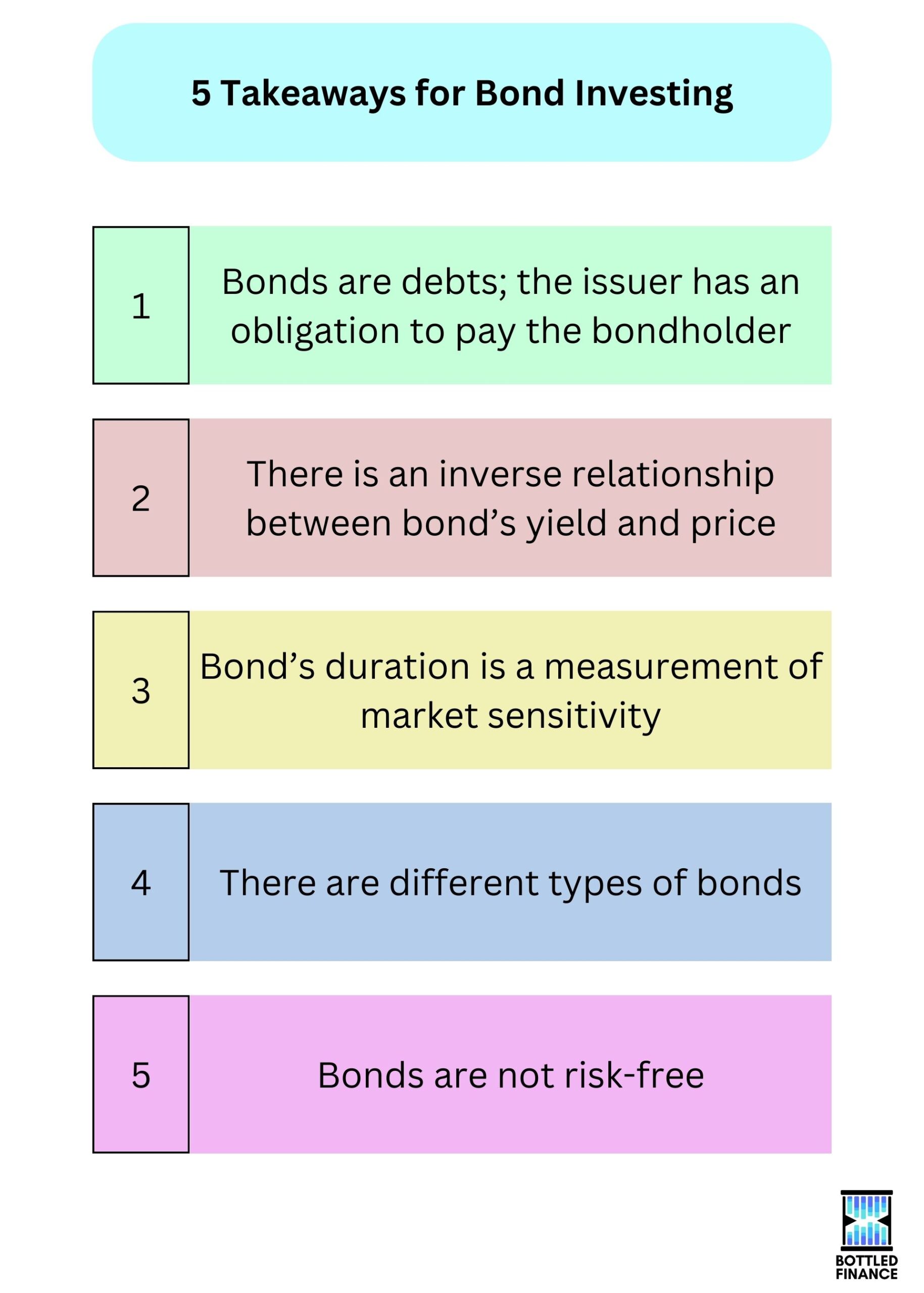

Theoretically, it seems like buying and holding a bond is a flawless strategy; BUT, investing in bonds is not as simple! Here are some of the things you should know before diving into bonds!

Terminology

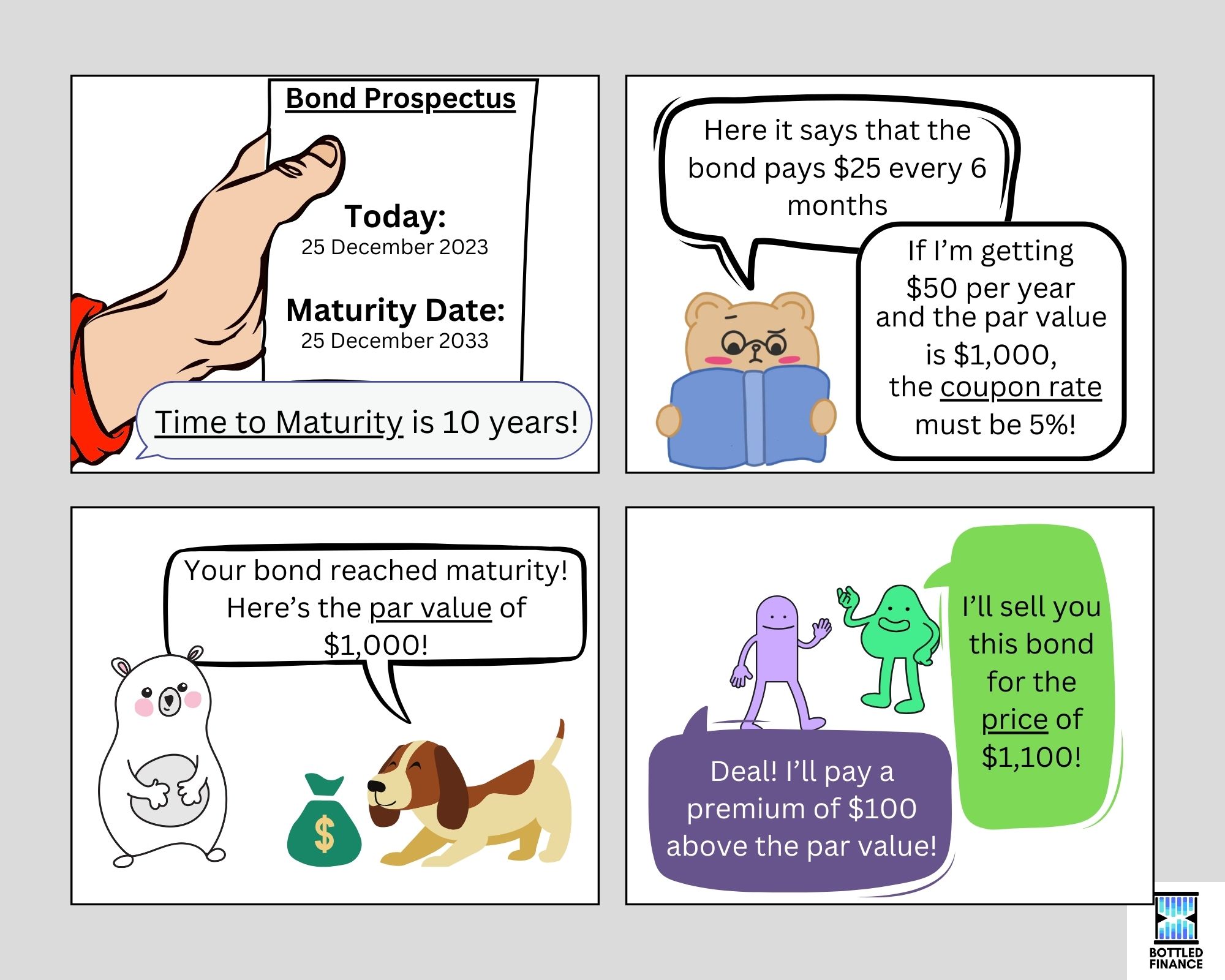

Term-to-Maturity

The time left until the bond matures. When the bond matures, the issuer is obligated to pay the bondholder a final coupon payment and a lump sum. Thus, the maturity date is the same as a loan’s due date.

Par Value

Also known as the face value or the maturity value, the Par Value is the lump sum amount that the bondholder would receive when the bond reaches maturity.

Interest Payments/Coupon Rates

Interest payments are the regular cash payments that most bonds would pay out. When the value is stated in terms of the percentage of the par value, it’s called the coupon rate.

Coupon rates are usually expressed on an annual basis, but the payment schedule could be once, twice, or even four times per year.

Price

Price is the amount a bondholder pays (or has to pay) for a bond. When a bond is purchased above its par value, it is known as a premium bond because the current market value to purchase the bond is at a premium compared to the par value.

The relationship between Interest Rates, Bond Yield, and Bond Price

There is an inverse relationship between bond prices and yield, when yield increases bond prices decrease. Why does yield fluctuate? Because of interest rates. When the interest rate rises, the yield of newly issued bonds increases, and the prices of older, lower-yielding bonds decrease accordingly.

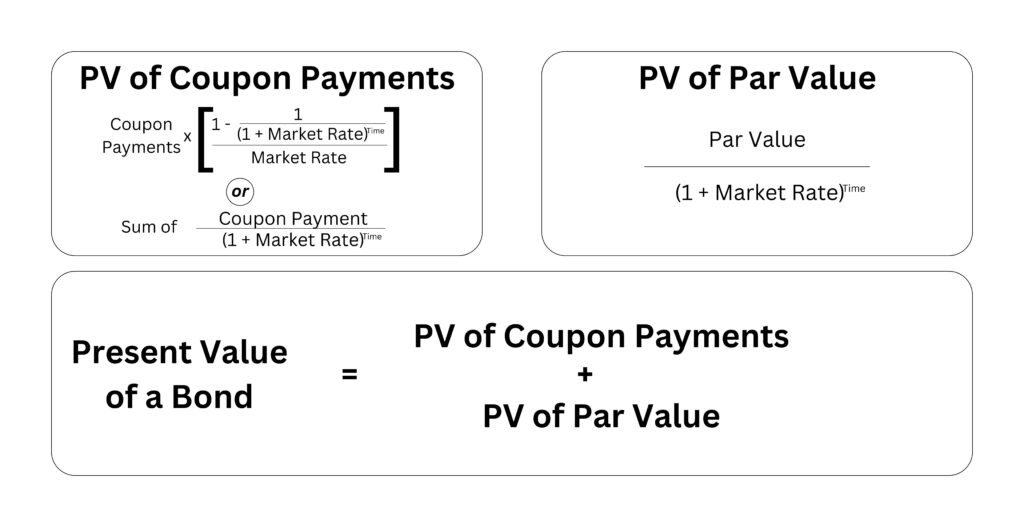

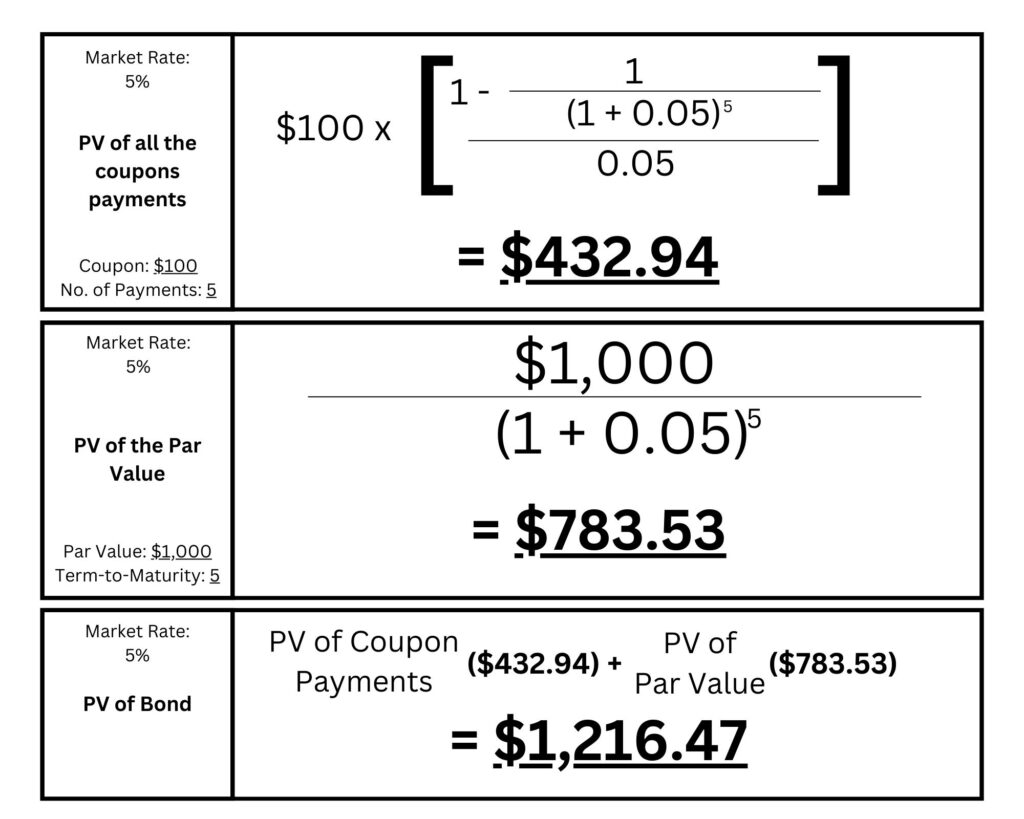

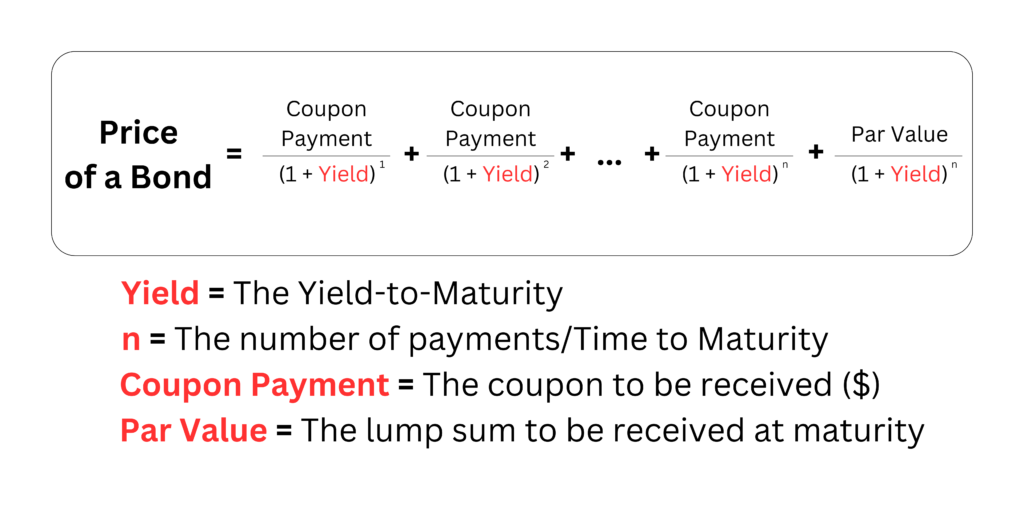

Calculating the Present Value of a bond

Due to inflation, the value of a dollar today is not the same as the value of a dollar in 10 years’ time. To properly understand how much we should pay today for a coupon-paying bond that matures in the future, we need to discount the cashflow back to today’s value (the present value).

- Coupon Payments = The dollar value to be received

- Market Rate = The current interest rate/discount rate

- Time = The time to maturity or the number of coupon payments remaining

- Par Value = The lump sum to be received at maturity

The present Value (PV) of a bond is simply the sum of the PV of all coupon payments + the PV of the par value.

Calculating the Yield of a bond

Because the price of a bond may fluctuate over time, but the coupon payment remains the same, understanding the yield gives bondholders an idea of the (expected) rate of return on their investment.

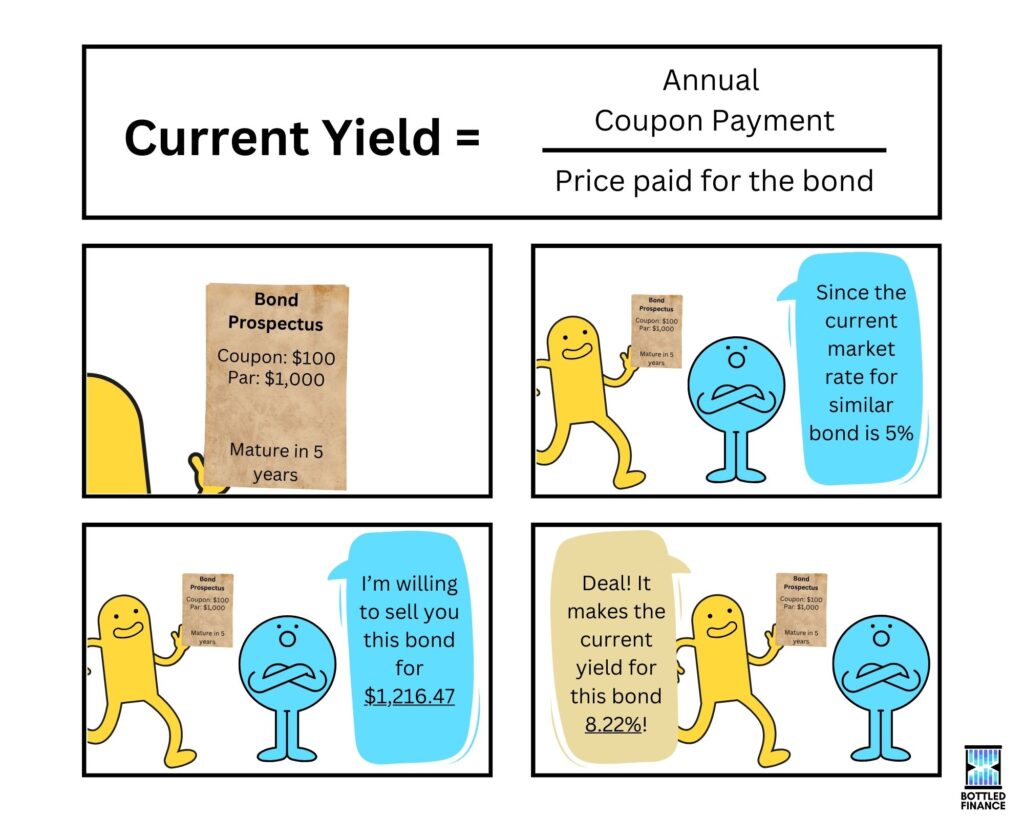

Current Yield

The current yield helps bondholders understand the percentage returns from coupon payments in relation to the amount paid for the bond.

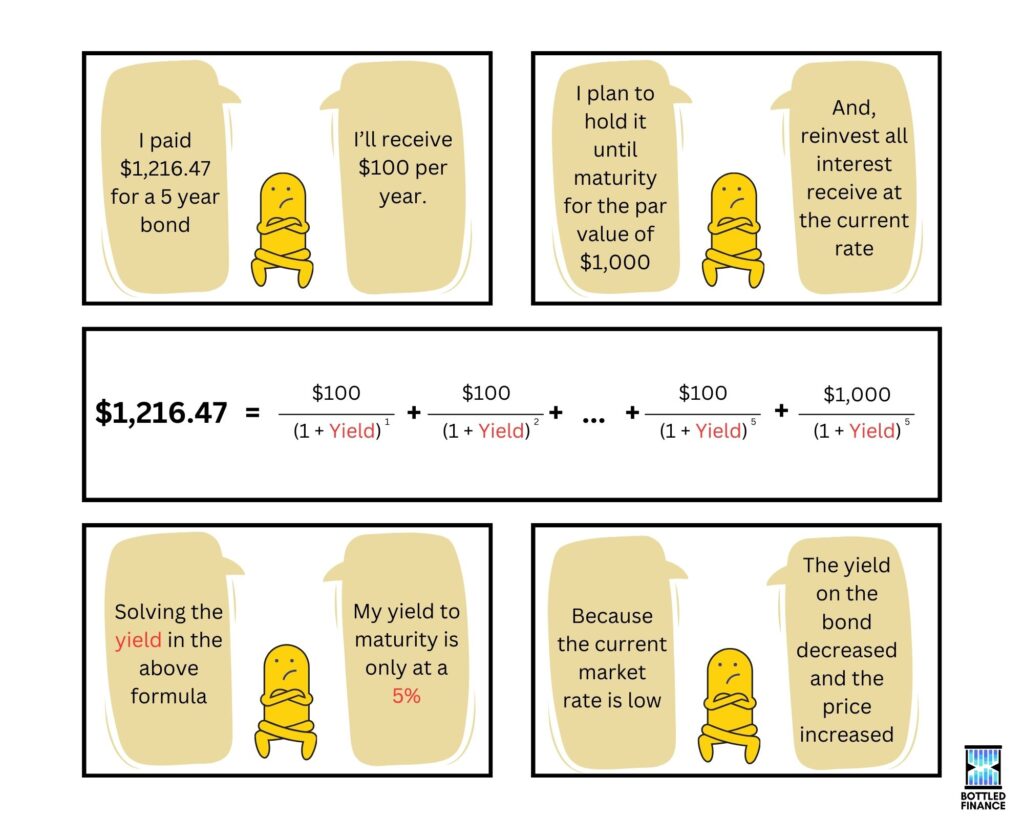

Yield-to-Maturity

The yield to maturity (YTM) is a commonly used measurement that assumes all coupons received will be reinvested.

The yield to maturity (also known as Internal Rate of Return) assumes two things: (1) the bond is held to maturity and (2) all interest payments are reinvested at the YTM rate.

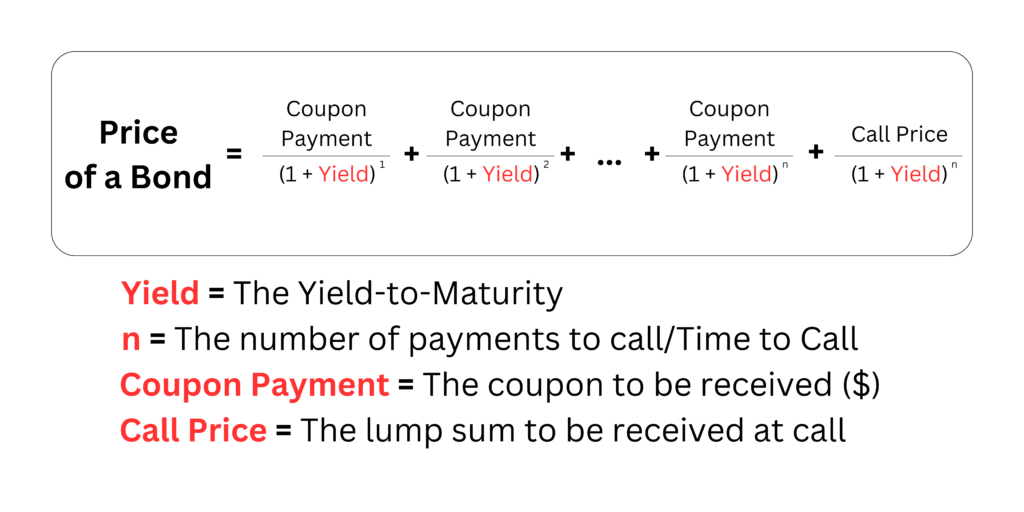

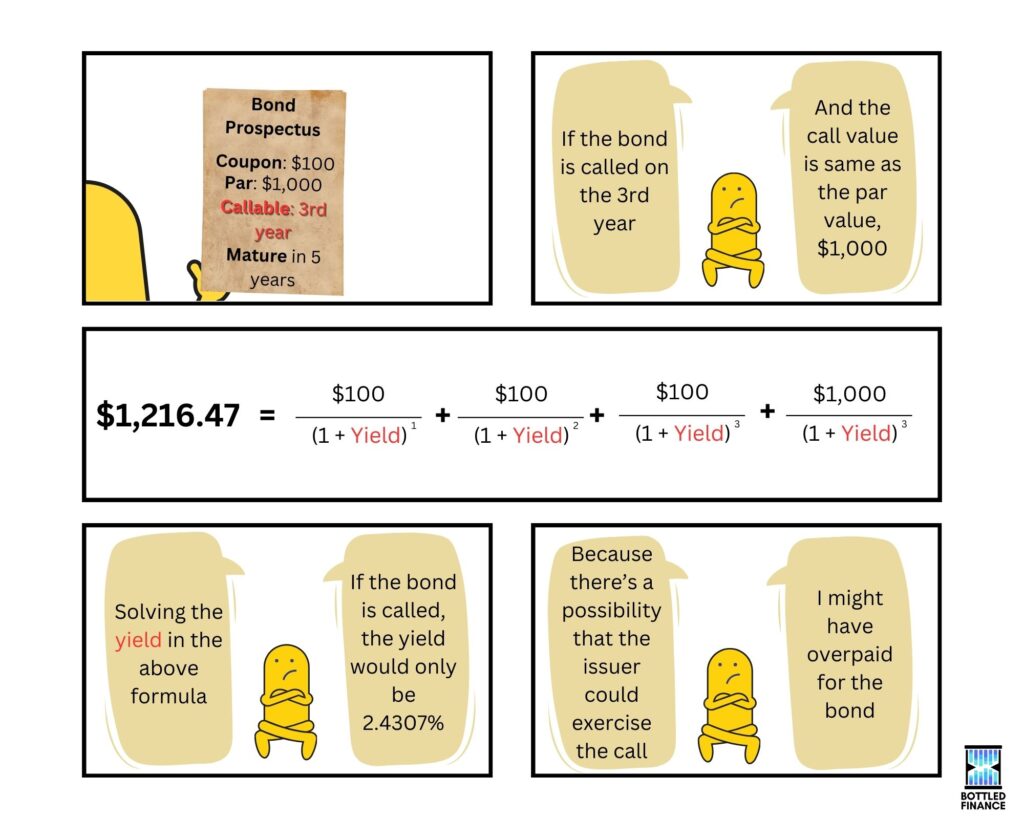

Yield-to-Call

The yield-to-maturity calculation assumes that the bond has no embedded option; if the issuer is able to buy back (call) the bond before its maturity date, then both the yield-to-maturity and yield-to-call should be calculated.

If a bond has more than one call price, then the yield should be calculated to the worst call price (yield-to-worst) because there’s a possibility that the bond would be called at the worst possible price.

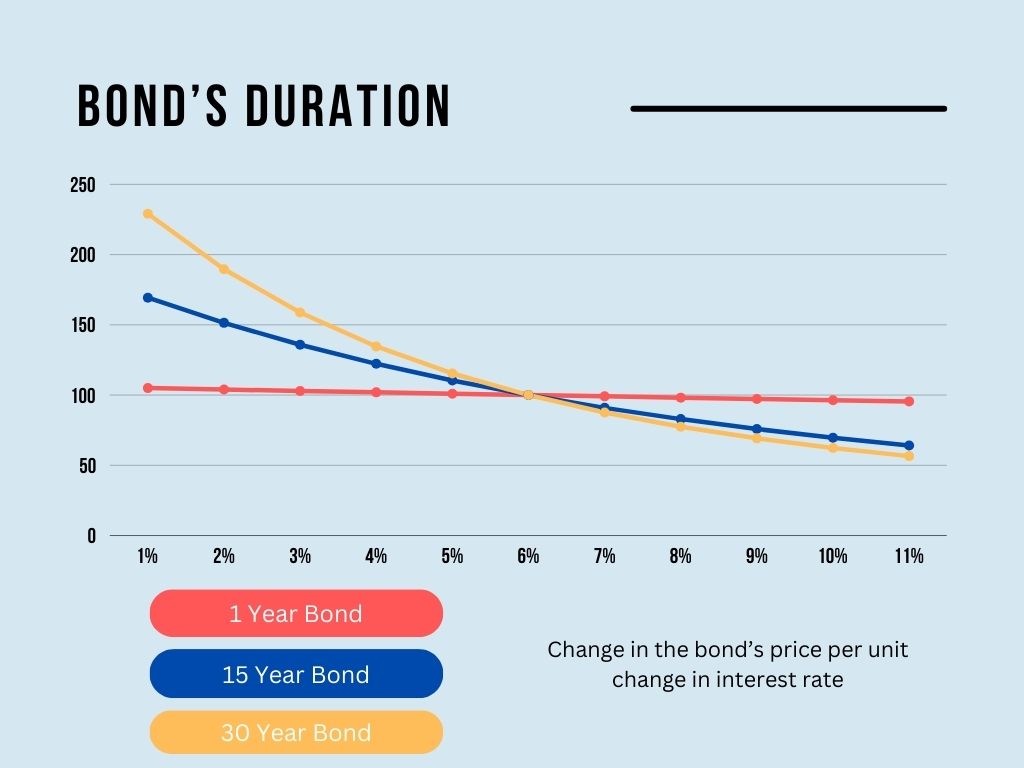

Duration of a bond

The term “duration” in this case, is a measurement of price sensitivity in relation to changes in interest rates; duration is a measurement of market risk.

Duration measures price change per one percent change in yield. The longer the time to maturity and the lower the coupon rate, the higher the volatility; meaning, the greater the price change per unit change in yield.

Different types of bond

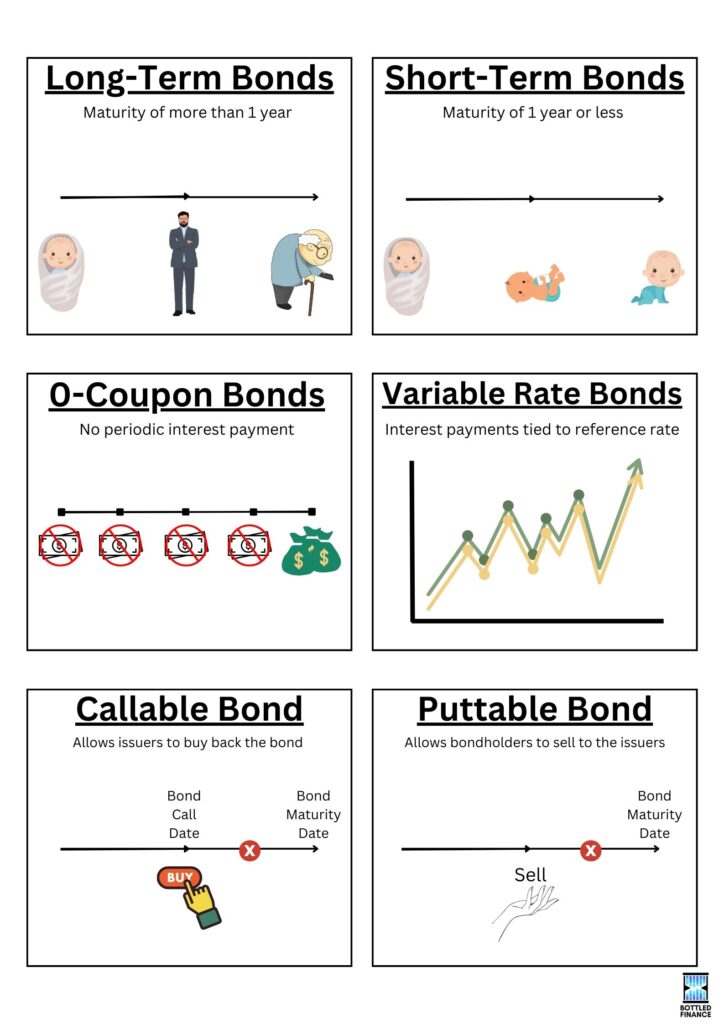

Long-Term Bond

Long-term bonds, also known as notes, usually have a term-to-maturity of around one to 10 years.

Short-Term Bond

Short-term bonds, sometimes called Treasury Bill (T-Bill) or Dollar Bill, usually mature in a year or less.

Zero-Coupon Bond

Owners of zero-coupon bonds do not receive interest payments; instead, most zero-coupon bonds are priced at a deep discount (significantly lower than the par value) and bondholders would earn from the differences between price paid and par value received at maturity.

Variable-Rate Bond

Floaters are bonds that have coupon rates that fluctuate throughout their lifetime, that’s why they are known as variable-rate bonds. The interest payments of floaters are usually tied to a specific reference rate and would move in relation to the reference rate, or in the opposite direction in the case of an inverse floater.

Bonds with embedded features

Callable Bond

Some bonds have a call option that allows the issuer to buy back the bond at a specific price before the maturity date. A callable bond would be less attractive to bondholders as there is a possibility that the issuer might call the bond at a less-than-ideal time, resulting in the loss of any future coupon payments and forcing the bondholder to reinvest in a bond with an unfavourable yield.

Puttable Bond

Bonds with put options allow the bondholders to sell the bond back to the issuer at a specific value before the maturity date. This is great for the bondholders as, regardless of the fluctuation of bond price or market interest rates, the bondholder could choose to redeem the bond at a predetermined price.

Risk associated with bonds

Like many investments, bonds are not entirely risk-free; while certain bonds are deemed to carry little default risk, others may be highly risky. Therefore, it is crucial to understand the different types of risk that a bond might carry.

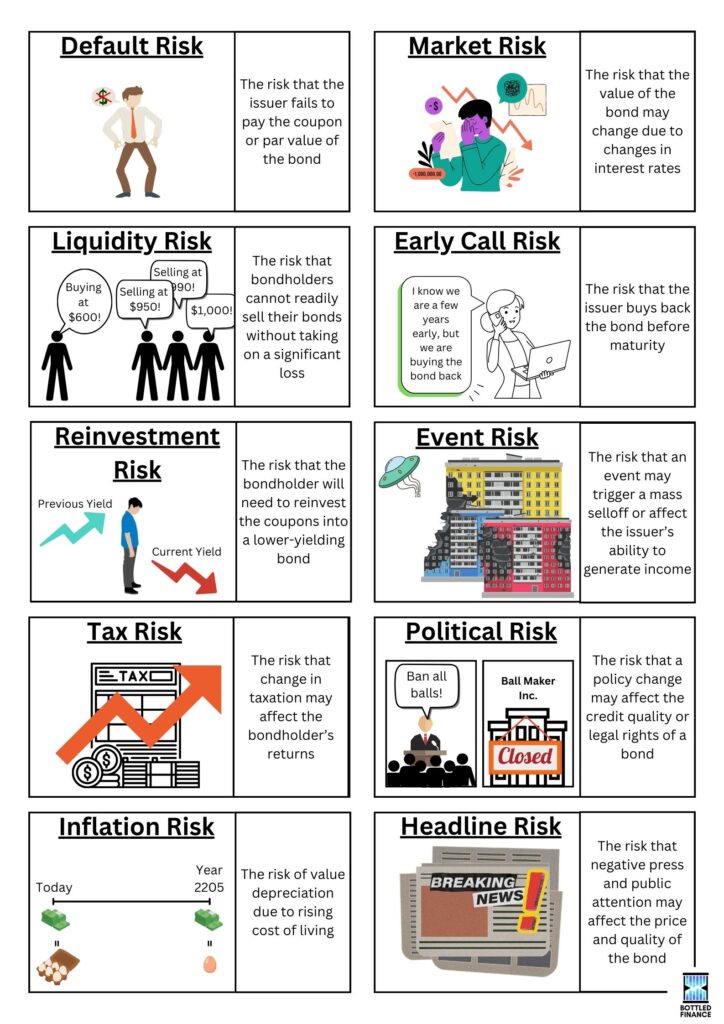

Default Risk

The risk that an issuer may not be able to make interest payments or pay the par value at maturity is called the default risk.

Market Risk

The risk that the value of a bond may change due to changes in interest rates is known as the market risk.

Liquidity Risk

Liquidity risk is the risk that bondholders cannot readily sell their bonds in the market without taking on a significant loss. If there aren’t enough market participants willing to trade, bondholders might need to price their bonds at a relatively low price in order to attract buyers.

Early Call Risk

For bonds with call options, the issuer could choose to exercise the option, that is, to buy back the bond at a predetermined price before the maturity date; bondholder of callable bonds faces the possibility that they may have to forgo the bonds at an undesirable time.

Reinvestment Risk

Any bondholders with coupon-paying bonds will risk having to reinvest their coupons into a lower-yielding bond.

Event Risk

Events such as wars or global virus outbreaks may trigger a mass selling of assets and affect the issuer’s ability to generate income. These events might affect the price, coupon payments, or principal payment of the bond.

Tax Risk

The possibility that a change in taxability on coupon bonds and capital gains on par value is known as tax risk. If additional tax is imposed on existing bonds, the returns for bondholders would be significantly affected by these changes.

Political Risk

There is a possibility that a change in law may affect the credit quality or legal rights of the bond. For example, if a government imposed a ban on imports of rocket fuel, all commercial space travelling companies would face operational difficulties and are at a higher risk of going out of business.

Inflation Risk

Due to the rising cost of living, a \$100 coupon received today has more buying power compared to a \$100 coupon received in 25 years’ time; that’s known as inflation risk.

Headline Risk

The risk that negative press and public attention of the issuer may drive the cost of borrowing up, reducing the demand and price of existing issuers. For example, if new research finds that the space travel industry is not viable, and an alternative teleportation technology has been developed, space travel companies may face difficulties attracting new investors and lenders and might need to increase the coupon rates for newly issued bonds in order to attract investors.

Assessing the quality of bonds

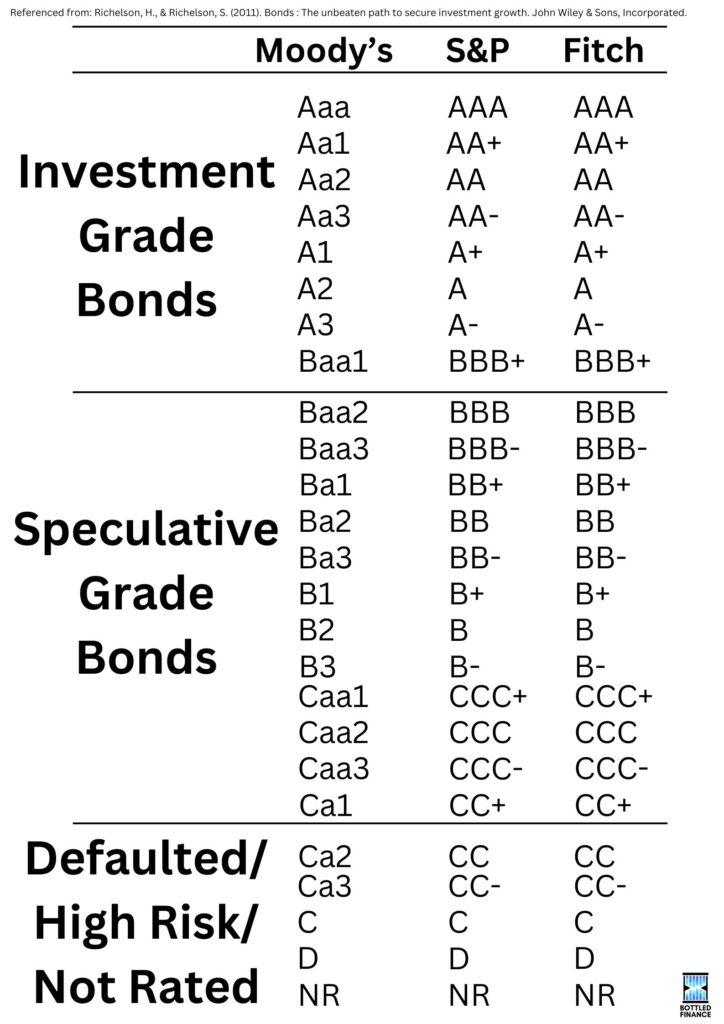

There are three primary bond-rating agencies: Mood’s, S&P, and Fitch. All three assign a certain rating to bonds and are a useful guide to evaluating and assessing the quality of the bond.

The highest-rated bonds are assumed to have little to no default risk; issuers of Aaa and AAA-rated bonds are expected to be able to pay bondholders their coupon payment on time and the par value when the bond matures.

All else equal, bonds in the same industry with similar ratings, coupon rates, and time to maturity should theoretically be priced similarly.

However, do note that the ratings are not comprehensive enough to be used to assess the bond in its entirety. When investing in bonds, bondholders should do their due diligence and investigate further rather than making decisions solely based on ratings.

Conclusion

Bonds are a great investment option that could help build consistent cash flow; however, potential bondholders are required to do their due diligence when assessing the viability of bonds. Some essential questions to be evaluated before making investment decisions are the bond’s par value, the coupon rate, the maturity date, any embedded options, the types of risk, the bond’s rating, and the yield

References

McKay, D. R., & Peters, D. A. (2019). Bond Basics and the Yield Curve. Plastic Surgery (Oakville (Ont.)), 27(1), 83–85. https://doi.org/10.1177/2292550319830964

Richelson, H., & Richelson, S. (2011). Bonds : The unbeaten path to secure investment growth. John Wiley & Sons, Incorporated.