While ‘Stocks’ and ‘Shares’ are often used interchangeably; by definition, a share is the smallest unit of ownership in a company, whereas stock is the total number of shares offered by the company (Kinsky, 2020).

However, in practice, both terms could generally mean the same thing (Hobson, 2012). Therefore, when someone says that they “own stocks of a company” or that they’ve just “brought some shares of a company”, they are describing the same thing.

As stocks and shares represent ownership of a company, everyone who has bought shares in a particular company has (a percentage of) ownership of the company (Hobson, 2012).

Being an owner (shareholder) of a publicly traded company allows shareholders the perks (such as a portion of the firm’s profit), but not the liabilities. The publicly traded company, by law, is its own entity, distinct from its owners (Hobson, 2012; Kinsky, 2020).

As most stocks can be readily bought or sold on the stock exchange, shareholders can generate a return on their investments by buying and selling the stocks, without being involved in the corporate matters of the firm (Kinsky, 2020).

How are Stocks Traded

For a trade to take place, both buyers and sellers must agree on a price and the number of shares to trade.

Although it is theoretically possible to reach out and negotiate with a willing buyer or seller, it is more practical for trades to be done through a brokerage firm, by placing trades using online platforms, or by speaking to a broker (Kinsky, 2020).

These trades would then be executed on the securities exchange (stock exchange), where buyers and sellers are matched without the need for direct negotiations (Kinsky, 2020).

However, not all companies are listed on the exchange. Unless the company becomes public, by means of an Initial Public Offering (IPO) on the Primary Market, ownerships of private companies are not typically accessible to investors (Kinsky, 2020).

Primary Market

The issuance and sale of new shares occur in the primary market. A private company can decide to raise capital by selling its ownership or part of its ownership to the public. The initial number of shares offered to the public is decided by the company itself (Hobson, 2012).

A public company can also choose to further issue more shares and increase its share outstanding (Hobson, 2012).

Initial Public Offerings (IPO)

The conversion from a private company to a public one happens during the initial public offering (IPO).

The IPO is where companies raise money for their expansion needs and the future development of the business. The number of shares to be issued during the IPO depends on the capital needs of the firm (Kinsky, 2020).

Existing owners of the (previously private) company can also choose to cash in and offer some of their shareholdings for sale during the IPO. Proceeds from the sales of their ownership go directly to them (Hobson, 2012; BarCharts, 2017).

After the Initial Public Offering (IPO), the (previously) private company becomes public and would be tradeable on the secondary market.

Secondary Market

For the majority of investors, most, if not all, of their trades would be done in the secondary market. The secondary market is where investors can trade previously issued stocks, bonds, and other financial instruments through their broker (Hobson, 2012; BarCharts, 2017).

The market price of each share would most likely be different from the IPO price. If an investor wants to purchase a share, they’ll have to pay whatever the current market price is; specifically, the price at which the seller is willing to sell. Similarly, if they are looking to sell a share, they’ll have to sell at a price the buyer is willing to buy (Hobson, 2012).

Alternatively, the investor could also place an order outside of the current market prices; to buy at a price that is lower or sell at a price that is higher than the current market price. However, their order may not be matched if nobody wants to buy from or sell to them, at their desired price. If an orders are not matched, no trades will be made (Hobson, 2012).

Different Classes of Shares

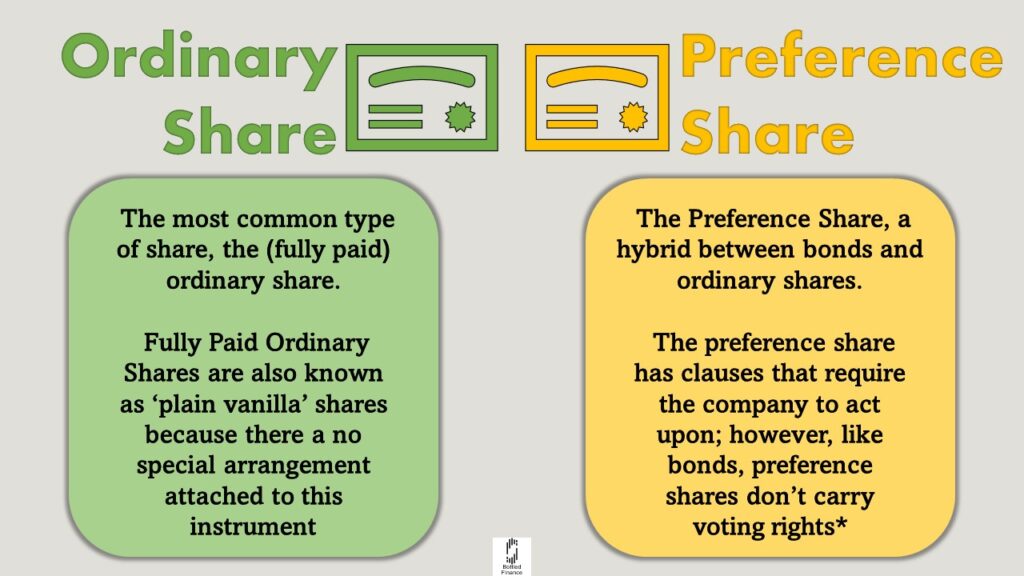

Ordinary Shares

The most common type of shares that are traded are fully paid ordinary shares. However, because nearly all shares are fully paid and the word ‘ordinary’ is usually dropped; generally, Fully Paid Ordinary Shares are only known simply as ‘Shares’ (Kinsky, 2020).

Ordinary shares are also known as ‘plain vanilla’ because there are no special arrangements or agreements attached to the instrument (Kinsky, 2020).

Preference Shares

The Preference Share is another class of share that behaves like a hybrid of a loan and an equity (Hobson, 2012; Kinsky, 2020).

The preference share has clauses that require the company to act upon, these clauses may include first rights to a dividend payout, cumulative dividend arrangement, specific set of rates at which the payout is supposed to be, and claimant priority over ordinary shareholders in case of bankruptcy, among other things (Hobson, 2012; Kinsky, 2020; BarCharts, 2017).

However, preferred shareholders forgo voting rights, unless the issue directly affects them (Hobson, 2012; Kinsky, 2020)

Corporate Action Events

Shareholders (owners) of a company can participate in certain business decisions known as corporate action events.

Ordinary shareholders have voting rights and can participate by casting their votes in these corporate action events (Hobson, 2012; Kinsky, 2020).

Shareholders are also entitled to any cash dividend and stock dividend distributions (Chetty & Saez, 2005; Hobson, 2012; Kinsky, 2020; Cornell, 2020).

How Companies Increase/Decrease its Shares

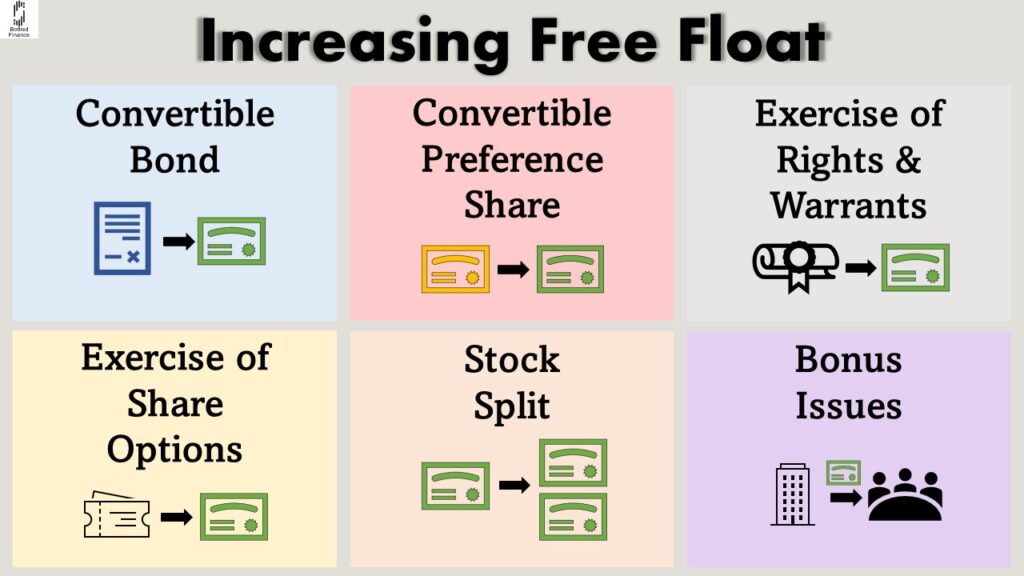

Increasing Free Float

The increase in free float (quantity of shares that can be publicly traded) happens when:

- Convertible bondholders convert their bonds into ordinary shares (Hobson, 2012),

- Convertible preferred shareholder converts their preference share to ordinary shares (Hobson, 2012),

- Rights and warrants holders exercise their rights and/or warrants to purchase shares directly from the company (Kinsky, 2020; Hobson, 2012; Olvik & Kangro, 2015),

- Employees exercising their employee share options, allowing them to purchase shares from the company (Hobson, 2012; Kinsky, 2020),

- The company decides to divide its current outstanding shares into multiple shares via a stock split (Cornell, 2020; Baker, Singleton, & Veit, 2011), or

- The company decides to issue additional shares to its existing shareholders (Hobson, 2012; Kinsky, 2020).

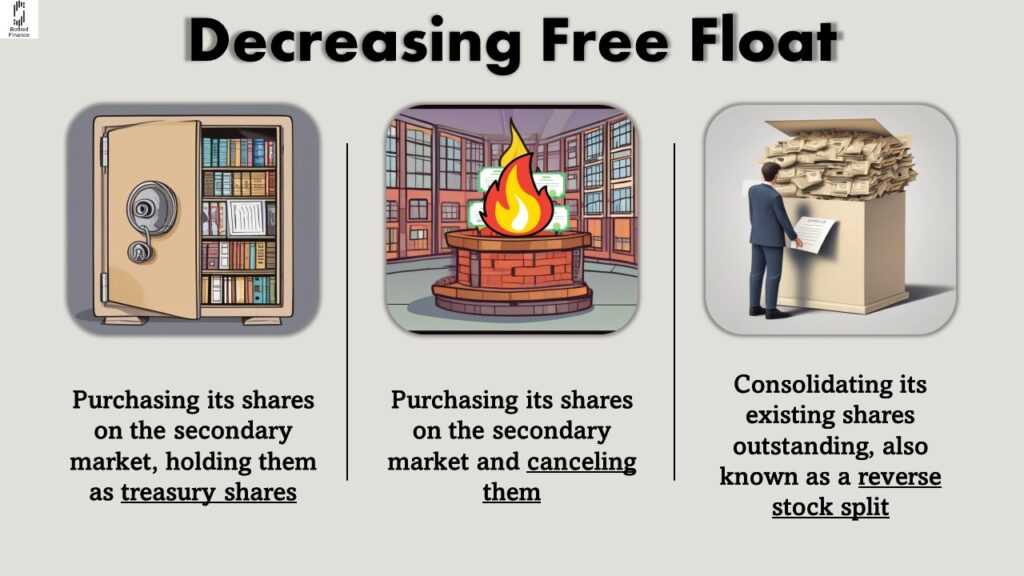

Decreasing Free Float

Companies can also reduce their free float by:

- Purchasing its shares on the secondary market, holding them as treasury shares (Hobson, 2012)

- Purchasing its shares on the secondary market and canceling them (Hobson, 2012)

- Consolidating its existing shares outstanding, also known as a reverse stock split (Hobson, 2012).

Concluding Remarks

Owning shares of a company means having (partial) ownership of that company; and with ownership comes perks such as profit sharing and voting rights.

However, do note that as the share prices are mostly determined by the market (the price that other investors are willing to buy and sell at), the price at which you purchase your shares and the price at which you may sell your shares (holding period returns) might net you a loss in your investments.

With all investments, comes risks, investors should properly assess their risk level before making any trades.

References

Baker, H. K., Singleton, J. C., & Veit, E. T. (2011). Dividends and Dividend Policy. In Survey Research in Corporate Finance. Oxford University Press. https://doi.org/10.1093/acprof:oso/9780195340372.003.0006

BarCharts, I. (2017). Corporate finance : Quickstudy reference guide. BarCharts Publishing, Inc..

Chetty, R., & Saez, E. (2005). Dividend Taxes and Corporate Behavior: Evidence from the 2003 Dividend Tax Cut. The Quarterly Journal of Economics, 120(3), 791–833. https://doi.org/10.1093/qje/120.3.79

Cornell, B. (2020). The Tesla stock split experiment. Journal of Asset Management, 21(7), 647-651. https://doi.org/10.1057/s41260-020-00191-0

Hobson, R. (2012). Shares Made Simple : A Beginner’s Guide to the Stock Market. Harriman House Publishing.

Kinsky, R. (2020). Teach Yourself about Shares : A Self-Help Guide to Successful Share Investing. John Wiley & Sons, Incorporated.

Olvik, A., & Kangro, R. (2015). Pricing of Warrants with Stock Price Dependent Threshold Conditions. Mathematical Modelling and Analysis, 20(4), 516-528. https://doi.org/10.3846/13926292.2015.1073187